(Explain Future Taxable and Deductible Amounts, How Carryback and Carryforward Affects Deferred Taxes) Mary Joe Fernandez and...

Question:

(Explain Future Taxable and Deductible Amounts, How Carryback and Carryforward Affects Deferred Taxes) Mary Joe Fernandez and Meredith McGrath are discussing accounting for income taxes.

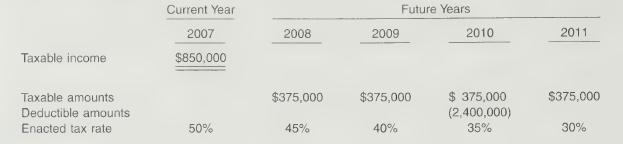

They are currently studying a schedule of taxable and deductible amounts that will arise in the future as a result of existing temporary differences. The schedule is as follows.

Instructions

(a) Explain the concept of future taxable amounts and future deductible amounts as illustrated in the schedule.

(b) How do the carryback and carryforward provisions affect the reporting of deferred tax assets and deferred tax liabilities?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: