Homespun Resources Ltd was incorporated in 20X2 and is a mining operation in northern Alberta. The company

Question:

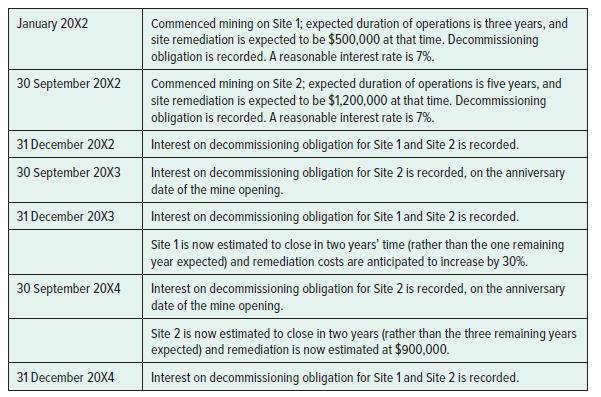

Homespun Resources Ltd was incorporated in 20X2 and is a mining operation in northern Alberta. The company is required by the terms of provincial legislation to remediate mine sites when mining is completed. The following events and decisions with respect to operations relate to Homespun’s decommissioning obligations:

Required:

1. Prepare journal entries for the events listed above.

2. Calculate the balance of the decommissioning obligation at each 31 December, from 20X2 to 20X4.

January 20X2 30 September 20X2 31 December 20X2 30 September 20X3 31 December 20X3 30 September 20X4 31 December 20X4 Commenced mining on Site 1; expected duration of operations is three years, and site remediation is expected to be $500,000 at that time. Decommissioning obligation is recorded. A reasonable interest rate is 7%. Commenced mining on Site 2; expected duration of operations is five years, and site remediation is expected to be $1,200,000 at that time. Decommissioning obligation is recorded. A reasonable interest rate is 7%. Interest on decommissioning obligation for Site 1 and Site 2 is recorded. Interest on decommissioning obligation for Site 2 is recorded, on the anniversary date of the mine opening. Interest on decommissioning obligation for Site 1 and Site 2 is recorded. Site 1 is now estimated to close in two years' time (rather than the one remaining year expected) and remediation costs are anticipated to increase by 30%. Interest on decommissioning obligation for Site 2 is recorded, on the anniversary date of the mine opening. Site 2 is now estimated to close in two years (rather than the three remaining years expected) and remediation is now estimated at $900,000. Interest on decommissioning obligation for Site 1 and Site 2 is recorded.

Step by Step Answer:

Requirement 1 Requirement 2 January 20x2 Mine site 1 Decommissioning ...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Silver Linings Ltd. commenced a mining operation in early 20X5. The company is required by the terms of provincial legislation to remediate the mine site when mining is completed, likely in five...

-

On 2 January 20X8, Keen Mining Ltd. commenced a mining operation. Keen is required by the terms of provincial legislation to remediate the mine site when mining is completed, likely in 10 years time....

-

On 2 January 20X8, Keen Mining Ltd. commenced a mining operation. Keen is required by the terms of provincial legislation to remediate the mine site when mining is completed, likely in 10 years time....

-

Pantheon Gaming, a computer enhancement company, has three product lines: audio enhancers, video enhancers, and connection-speed accelerators. Common costs are allocated based on relative sales. A...

-

For lighter, stable isotopes, the ratio of the mass number to the atomic number is close to a certain value. What is the value? What happens to the value of the mass number to atomic number ratio as...

-

9. How the payback period of a capital expenditure project is calculated.

-

49. Matt works for Fresh Corporation. Fresh offers a cafeteria plan that allows each employee to receive $15,000 worth of benefits each year. The menu of benefits is as follows: Benefit Cost Health...

-

The costs of rework are always charged to the specific jobs in which the defects were originally discovered. Do you agree? Explain.

-

Exercise 7-49 (Algorithmic) Depreciation Methods Clearcopy, a printing company, acquired a new press on January 1, 2019. The press cost $171,600 and had an expected life of 8 years or 4,500,000 pages...

-

Gaudet Industries Ltd. has a $5,000,000 note payable outstanding. The terms of the note require repayment of principal on 30 June 20X2. The company is now finalizing the financial statements for the...

-

The following are independent possible provisions: a. Willow Corp. sued a local supplier for $99,000. Willow Corp. lost the lawsuit but subsequently appealed. Willow Corp. won the appeal as it...

-

During 2016 (its first year of operations) and 2017, Batali Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2018, Batali decided to...

-

Convert the following information into: a) a semantic net b) a frame-based representation A Ford is a type of car. Bob owns two cars. Bob parks his car at home.His house is in California, which is a...

-

Visit www.pearsonglobaleditions.com/malhotra to read the video case and view the accompanying video. Marriott: Marketing Research Leads to Expanded Offerings highlights Marriotts success in using...

-

The water level in a tank is \(20 \mathrm{~m}\) above the ground. A hose is connected to the bottom of the tank, and the nozzle at the end of the hose is pointed straight up. The tank cover is...

-

A simple experiment has long been used to demonstrate how negative pressure prevents water from being spilled out of an inverted glass. A glass that is fully filled by water and covered with a thin...

-

A golf ball is hit on a level fairway. When it lands, its velocity vector has rotated through an angle of 90. What was the launch angle of the golf ball? Pyo By Dyz =0 Uso Range R x max dya

-

Consider the data from the first replicate of Exercise 14-15, assuming that four blocks are required. Confound ABD and ABC (and consequently CD) with blocks. (a) Construct a design with four blocks...

-

Assume Eq. 6-14 gives the drag force on a pilot plus ejection seat just after they are ejected from a plane traveling horizontally at 1300 km/h. Assume also that the mass of the seat is equal to the...

-

Refer to the data for Duster Corporation's defined benefit pension plan in BE19.9. Now assume that the company follows ASPE instead of IFRS. Determine the 2020 effect of the pension plan on pension...

-

The following information is available for Huntley Corporation's pension plan for the year 2020: Instructions a. Calculate pension expense for the year 2020, and provide the entries to recognize the...

-

Refer to the data in P19.9, except now assume Dela Corporation reports under IFRS. Depending on what your instructor assigns, do either parts (a), (b), (c), and (e) or parts (d) and (e). Data From...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total...

-

Mrquered Mrquered

-

You plan to invest $10,00 today in an investment account earning 5% interest. You then plan to invest an additional $1,000 into this account each year for the next twenty years. How much money will...

Study smarter with the SolutionInn App