In 20X6, Black Oil Inc. changed its method of accounting for oil exploration costs from the successful

Question:

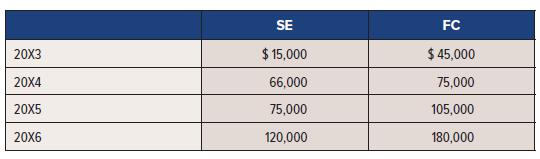

In 20X6, Black Oil Inc. changed its method of accounting for oil exploration costs from the successful efforts method (SE) to full costing (FC) for financial reporting because of a change in corporate reporting objectives. Black Oil has been in the oil exploration business since January 20X3; prior to that, the company was active in oil transportation. Pre-tax earnings under each method:

Black Oil reports the result of years 20X4 through 20X6 in its 20X6 annual report and has a calendar fiscal year. The tax rate is 30%. The change is made for accounting purposes but not for tax purposes. Thus, the deferred income tax account is changed.

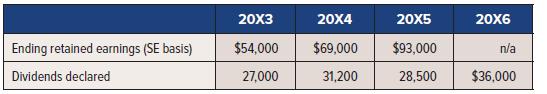

Additional information:

Required:

1. Prepare the entry in 20X6 to record the accounting change. Use “natural resources” as the depletable asset account.

2. Prepare the retained earnings section of the comparative statement of changes in equity. Include three years: 20X6, 20X5, and 20X4.

3. Explain how the accounting policy change would affect the statement of cash flows.

Step by Step Answer: