Kevin, its such a relief to get this ($2,000,000) of financing in place at a reasonable cost.

Question:

“Kevin, it’s such a relief to get this \($2,000,000\) of financing in place at a reasonable cost. We finally have the go-ahead for that new equipment! If we order now, we’ll have it in place and operating next year this time, what with production, shipping, installation, and test¬ ing. We’ll have to use some of our own money for this, but we’ll now be able to pay for it. Max Benstead was excited as he called you, Kevin Mohammed, into his office.

Max is the CFO of Dry Clean Depot Limited (DCDL), a company with a chain of 40 dry cleaning stores in Southern Ontario. DCDL’s retail stores are leased, under three- to five- year leases, in various malls and store-front locations. Each pod of retail outlets is served by one larger hub location where the dry cleaning operation is performed; clothes are trans¬ ported to and from the hub locations daily.

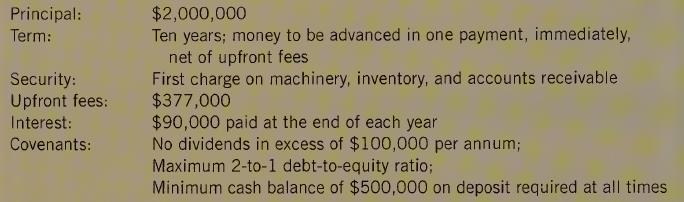

The new loan has the following terms;

You are a professional accountant, reporting to Max, and he has asked you to analyze any accounting implications of the new loan, along with some other issues in relation to accounting policies for the areas that Max has listed. Fie has requested a brief report on his desk tomorrow.

DCDL has revenues of approximately \($7,000,000\), and an average gross profit rate of 60%. Operating costs, including occupancy and labour, are high. The company complies with IFRS, despite being a private company. Max influenced this decision, knowing that the company might be part of a public offering in the future, but also because Max wished to develop expertise in IFRS applications to enhance his own personal skills profile.

Required:

Write the report.

Step by Step Answer: