KLB Corp., a private company, has used the completed-contract method to account for its longterm construction contracts

Question:

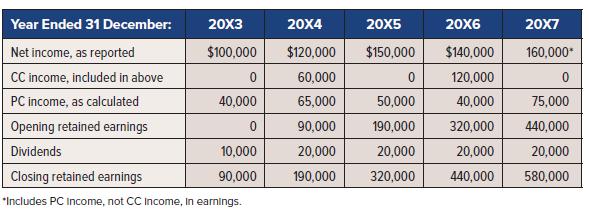

KLB Corp., a private company, has used the completed-contract method to account for its longterm construction contracts since its inception in 20X3. On 1 January 20X7, management decided to change to the percentage-of-completion method to better reflect operating activities and conform to industry norms. Completed contract was used for income tax purposes and will continue to be used for income tax purposes in the future. The income tax rate is 25%. The following information has been assembled:

Required:

1. Identify the type of accounting change involved. Which approach should be used— retrospective with full restatement, retrospective with limited restatement, or prospective without restatement? Explain.

2. Give the entry to appropriately reflect the accounting change in 20X7, the year of the change.

3. Restate the 20X7 retained earnings section of the statement of changes in equity, including the 20X6 comparative figures.

4. Assume that only the opening balance in 20X7 can be restated and that the cumulative effect cannot be allocated to individual years. Recast the 20X7 comparative retained earnings section of the statements of changes in equity accordingly.

5. Assume that no balances can be restated. Should the change be made in 20X7? Explain.

Step by Step Answer: