(Long-Term Contract with Interim Loss) On March 1, 2007, Franziska van Almsick Construc- 4,5) tion Company contracted...

Question:

(Long-Term Contract with Interim Loss) On March 1, 2007, Franziska van Almsick Construc-

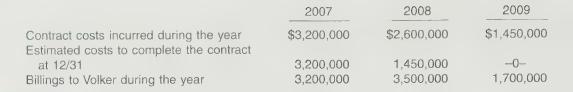

4,5) tion Company contracted to construct a factory building for Sandra Volker Manufacturing Inc. for a total contract price of $8,400,000. The building was completed by October 31, 2009. The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Volker for 2007, 2008, and 2009 are given on the next page.

Instructions

(a) Using the percentage-of-completion method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2007, 2008, and 2009.

(Ignore income taxes.)

(b) Using the completed-contract method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 2007, 2008, and 2009. (ignore incomes taxes.)

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield