MacDonald Corp. had the following securities outstanding at its fiscal year-end 31 December 20X7: Additional information: a.

Question:

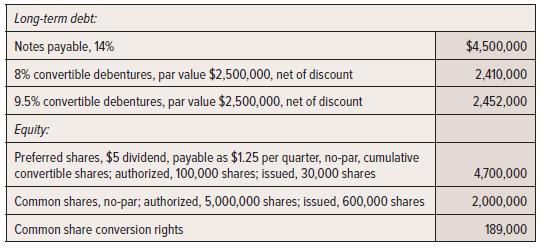

MacDonald Corp. had the following securities outstanding at its fiscal year-end 31 December 20X7:

Additional information:

a. 20X7 net earnings were $790,000. There were no discontinued operations.

b. Interest expense was $216,000 on the 8% debentures, and $250,000 on the 9.5% debentures.

c. Options to purchase 200,000 common shares at $11 per share beginning in 20X15 were outstanding throughout the year.

d. Additional options were issued on 1 May 20X7 to purchase 50,000 common shares at $27 per share in 20X9. The price per share becomes $25 in 20X10 and $20 in 20X11. These options expire at the end of 20X11.

e. The preferred shares are convertible into common shares at a rate of 9-for-1. They were issued on 1 October 20X7.

f. The 8% convertible debentures are convertible at the rate of seven shares for each $100 bond. The 9.5% convertible debentures are convertible at the rate of six shares for each $100 bond.

g. The tax rate is 30%; common shares traded for an average of $40 during the year.

h. No common shares were issued or retired during the year.

Required:

Calculate all EPS disclosures.

Step by Step Answer: