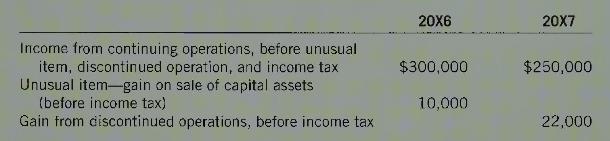

Maynes Limited reported the following information (in thousands) for 20X6 and 20X7: Mayne's income tax rate is

Question:

Maynes Limited reported the following information (in thousands) for 20X6 and 20X7:

Mayne's income tax rate is \(35 \%\). The 20X6 unusual gain is not taxable until 20X7. The 20X7 gain on discontinued operations is fully taxable in \(20 \mathrm{X} 7\).

Mayne's income tax rate is \(35 \%\). The 20X6 unusual gain is not taxable until 20X7. The 20X7 gain on discontinued operations is fully taxable in \(20 \mathrm{X} 7\).

Required:

1. Prepare a partial statement of profit and loss in good form for \(20 X 6\) and 20X7, starting with "Income from continuing operations, before unusual item and discontinued operations, and income tax," using two different methods:

a. Taxes payable method.

b. Comprehensive tax allocation.

2. Explain the circumstances under which Maynes Limited could use the taxes payable method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: