(NOL Carryback and Carryforward, Valuation Account versus No Valuation Account) Spamela Hamderson Inc. reports the following pretax...

Question:

(NOL Carryback and Carryforward, Valuation Account versus No Valuation Account)

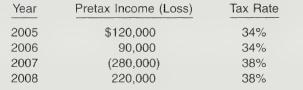

Spamela Hamderson Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.)

The tax rates listed were all enacted by the beginning of 2005.

Instructions

(a) Prepare the journal entries for the years 2005-2008 to record income tax expense (benefit) and income tax payable (refundable) and the tax effects of the loss carryback and carryforward, assuming that at the end of 2007 the benefits of the loss carryforward are judged more likely than not to be realized in the future.

(b) Using the assumption in (a), prepare the income tax section of the 2007 income statement beginning with the line “Operating loss before income taxes.”

(c) Prepare the journal entries for 2007 and 2008, assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized.

(d) Using the assumption in (c), prepare the income tax section of the 2007 income statement beginning with the line “Operating loss before income taxes.”

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield