On January 1, 2020, K. Crew Inc. reported a ($ 6,000) credit balance in its Accumulated OCIPension

Question:

On January 1, 2020, K. Crew Inc. reported a \(\$ 6,000\) credit balance in its Accumulated OCI—Pension Gain/Loss account related to its pension plan. During 2020, the following events occurred.

- Actual return on plan assets was \(\$ 8,000\), and expected return on plan assets was \(\$ 10,000\).

- A gain on the PBO of \(\$ 4,000\) was determined by the actuary at December 31, 2020, based on changes in actuarial assumptions.

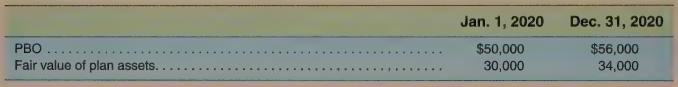

K. Crew amortizes unrecognized gains and losses using the corridor approach over the average remaining service life of active employees ( 20 years for 2020 and 2021). Further information on this plan follows.

Required

a. Compute amortization of Accumulated OCI—Pension Gain/Loss for 2020 using the corridor approach.

b. Compute the balance in Accumulated OCI-Pension Gain/Loss on December 31, 2020.

c. Compute amortization of Accumulated OCI—Pension Gain/Loss for 2021 using the corridor approach.

d. Instead, now assume that K. Crew elects to amortize Accumulated OCI-Pension Gain/Loss using the straight-line method. Compute amortization of Accumulated OCI--Pension Gain/Loss for 2020 and 2021.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo