Peele Inc. has hired you as an analyst to assist with making an investment decision. The choice

Question:

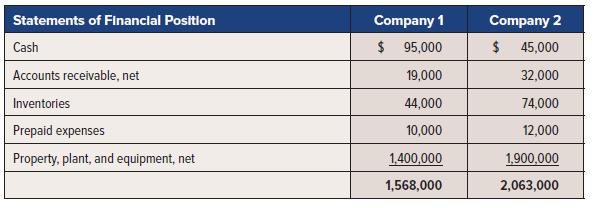

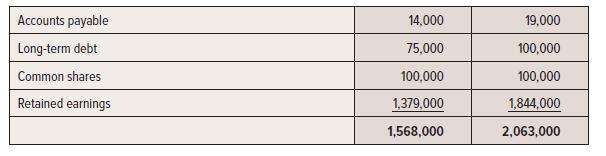

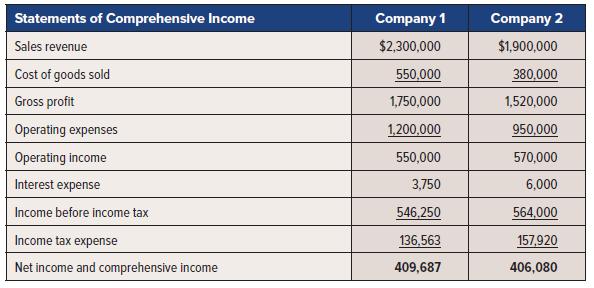

Peele Inc. has hired you as an analyst to assist with making an investment decision. The choice has been narrowed down to two companies, and a decision must be made on which of the two Peele Inc. should invest in. The two companies, Company 1 and Company 2, operate in the same industry. The most recent full-year financial statements are provided for Company 1 and Company 2 for the 31 December 20X5 year-ends.

Required:

1. Calculate and interpret the following ratios: quick ratio, accounts receivable turnover, inventory turnover, total debt to equity, return on total assets after tax, return on equity, times interest earned. Round to two decimal places.

2. Prepare a vertical analysis on the statements of comprehensive income. Round to one decimal place.

3. Recommend an investment choice for Peele Inc.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel