Question:

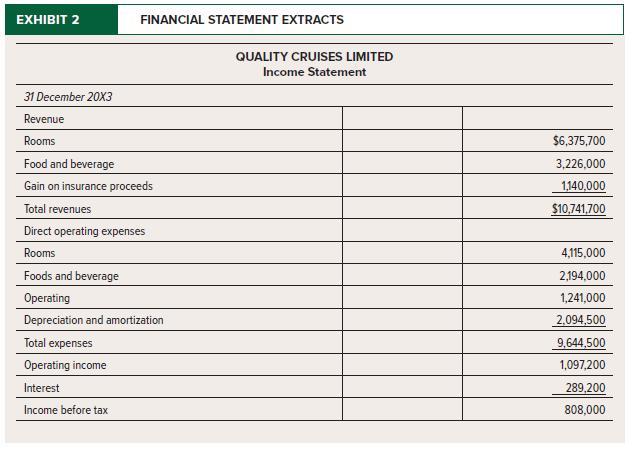

Quality Cruises Ltd. (QCL) is a Canadian company that was formed 10 years ago but has only been marginally profitable. Recent severe losses have significantly reduced its equity base and made QCL the subject of scrutiny by lenders, who want to ensure the company is viable. In 20X3, secured creditors have requested audited statements for the first time. A description of operations is presented in Exhibit 1.

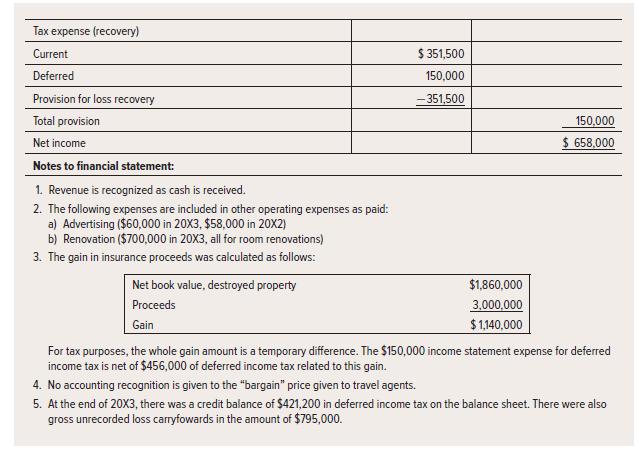

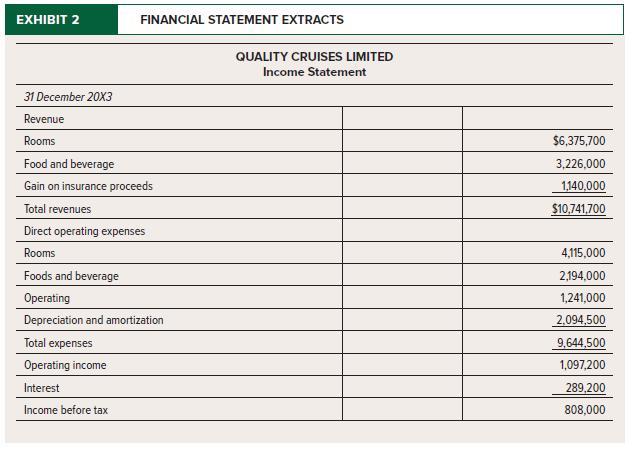

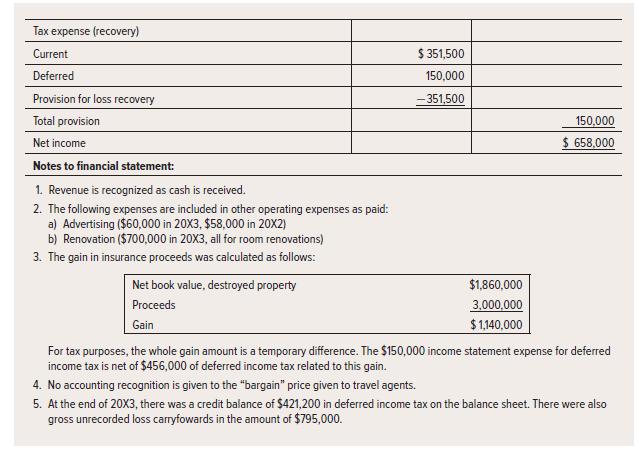

As a CPA, you have been contracted as an independent consultant to ensure appropriate financial reporting at QCL. The 20X3 draft financial statements as prepared by QCL have been provided to you (see Exhibit 2 for extracts from these statements). QCL complies with ASPE, but it has been asked by lenders to use comprehensive tax allocation in order to preserve comparability with other entities. The company’s tax rate is 40%.

Required:

Adopt the role of the CPA consultant and prepare a report analyzing accounting policies at QCL. You will want to quantify, where possible, the 20X3 earnings impact of any recommended changes.

Transcribed Image Text:

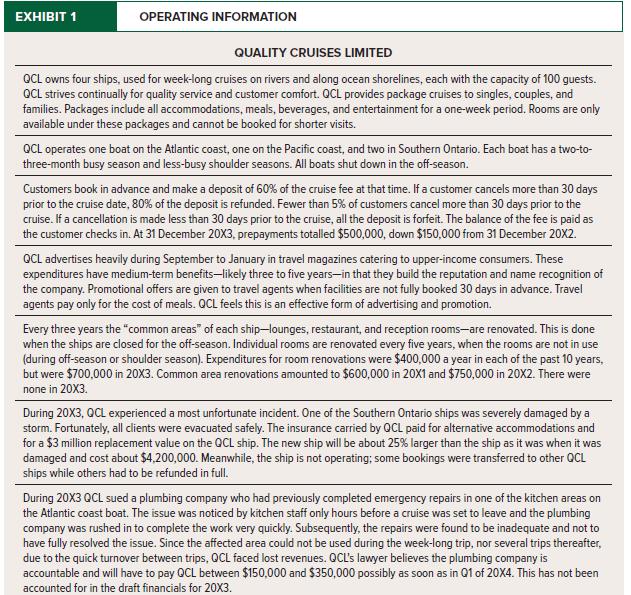

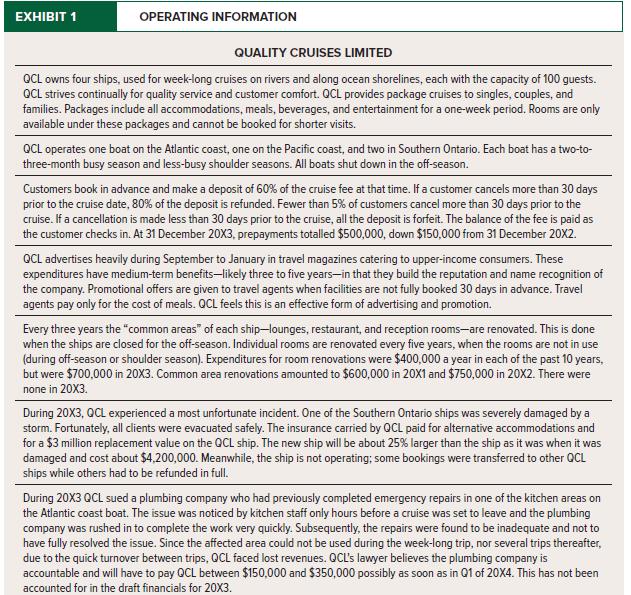

EXHIBIT 1

OPERATING INFORMATION

QUALITY CRUISES LIMITED

QCL owns four ships, used for week-long cruises on rivers and along ocean shorelines, each with the capacity of 100 guests.

QCL strives continually for quality service and customer comfort. QCL provides package cruises to singles, couples, and

families. Packages include all accommodations, meals, beverages, and entertainment for a one-week period. Rooms are only

available under these packages and cannot be booked for shorter visits.

QCL operates one boat on the Atlantic coast, one on the Pacific coast, and two in Southern Ontario. Each boat has a two-to-

three-month busy season and less-busy shoulder seasons. All boats shut down in the off-season.

Customers book in advance and make a deposit of 60% of the cruise fee at that time. If a customer cancels more than 30 days

prior to the cruise date, 80% of the deposit is refunded. Fewer than 5% of customers cancel more than 30 days prior to the

cruise. If a cancellation is made less than 30 days prior to the cruise, all the deposit is forfeit. The balance of the fee is paid as

the customer checks in. At 31 December 20X3, prepayments totalled $500,000, down $150,000 from 31 December 20X2.

QCL advertises heavily during September to January in travel magazines catering to upper-income consumers. These

expenditures have medium-term benefits-likely three to five years in that they build the reputation and name recognition of

the company. Promotional offers are given to travel agents when facilities are not fully booked 30 days in advance. Travel

agents pay only for the cost of meals. QCL feels this is an effective form of advertising and promotion.

Every three years the "common areas" of each ship-lounges, restaurant, and reception rooms-are renovated. This is done

when the ships are closed for the off-season. Individual rooms are renovated every five years, when the rooms are not in use

(during off-season or shoulder season). Expenditures for room renovations were $400,000 a year in each of the past 10 years,

but were $700,000 in 20X3. Common area renovations amounted to $600,000 in 20X1 and $750,000 in 20X2. There were

none in 20X3.

During 20X3, QCL experienced a most unfortunate incident. One of the Southern Ontario ships was severely damaged by a

storm. Fortunately, all clients were evacuated safely. The insurance carried by QCL paid for alternative accommodations and

for a $3 million replacement value on the QCL ship. The new ship will be about 25% larger than the ship as it was when it was

damaged and cost about $4,200,000. Meanwhile, the ship is not operating; some bookings were transferred to other QCL

ships while others had to be refunded in full.

During 20X3 QCL sued a plumbing company who had previously completed emergency repairs in one of the kitchen areas on

the Atlantic coast boat. The issue was noticed by kitchen staff only hours before a cruise was set to leave and the plumbing

company was rushed in to complete the work very quickly. Subsequently, the repairs were found to be inadequate and not to

have fully resolved the issue. Since the affected area could not be used during the week-long trip, nor several trips thereafter,

due to the quick turnover between trips, QCL faced lost revenues. QCL's lawyer believes the plumbing company is

accountable and will have to pay QCL between $150,000 and $350,000 possibly as soon as in Q1 of 20X4. This has not been

accounted for in the draft financials for 20X3.