(Ratio Analysis) Edna Millay Inc. is a manufacturer of electronic components and accessories with total assets of...

Question:

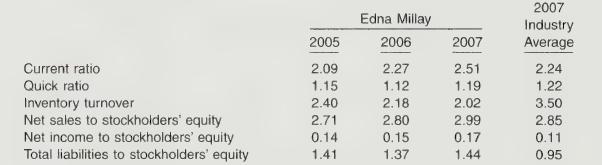

(Ratio Analysis) Edna Millay Inc. is a manufacturer of electronic components and accessories with total assets of $20,000,000. Selected financial ratios for Millay and the industry averages for firms of similar size are presented below.

Millay is being reviewed by several entities whose interests vary, and the company’s financial ratios are a part of the data being considered. Each of the parties listed below must recommend an action based on its evaluation of Millay’s financial position.

Archibald MacLeish Bank. The bank is processing Millay’s application for a new 5-year term note.

Archibald MacLeish has been Millay’s banker for several years but must reevaluate the company’s financial position for each major transaction.

Robert Lowell Company. Lowell is a new supplier to Millay and must decide on the appropriate credit terms to extend to the company.

Robert Penn Warren. A brokerage firm specializing in the stock of electronics firms that are sold overthe-

counter, Robert Penn Warren must decide if it will include Millay in a new fund being established for sale to Robert Penn Warren’s clients.

Working Capital Management Committee. This is a committee of Millay’s management personnel chaired by the chief operating officer. The committee is charged with the responsibility of periodically reviewing the company’s working capital position, comparing actual data against budgets, and recommending changes in strategy as needed.

Instructions

(a) Describe the analytical use of each of the six ratios presented above.

(b) For each of the four entities described above, identify two financial ratios, from those ratios presented in Illustration 24A-1 (on page 1317), that would be most valuable as a basis for its decision regarding Millay.

(c) Discuss what the financial ratios presented in the question reveal about Millay. Support your answer by citing specific ratio levels and trends as well as the interrelationships between these ratios.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield