(Revenue Recognition MethodsComparison) Joys Construction is in its fourth year of business. Joy performs long-term construction projects...

Question:

(Revenue Recognition Methods—Comparison) Joy’s Construction is in its fourth year of business.

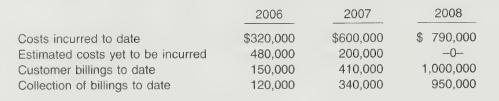

Joy performs long-term construction projects and accounts for them using the completed-contract method. Joy built an apartment building at a price of $1,000,000. The costs and billings for this contract (Lo 3, for the first three years are as follows.

Joy has contacted you, a certified public accountant, about the following concern. She would like to attract some investors, but she believes that in order to recognize revenue she must first “deliver” the product. Therefore, on her balance sheet, she did not recognize any gross profits from the above contract until 2008, when she recognized the entire $210,000. That looked good for 2008, but the preceding years looked grim by comparison. She wants to know about an alternative to this completed-contract revenue recognition.

Instructions Draft a letter to Joy, telling her about the percentage-of-completion method of recognizing revenue. Compare it to the completed-contract method. Explain the idea behind the percentage-of-completion method.

In addition, illustrate how much revenue she could have recognized in 2006, 2007, and 2008 if she had used this method.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield