Sable Company purchased merchandise for resale on 1 January 20X5, for ($5,000) cash plus a ($20,000), two-year

Question:

Sable Company purchased merchandise for resale on 1 January 20X5, for \($5,000\) cash plus a \($20,000\), two-year note payable. The principal is due on 31 December 20X6; the note specified 3% interest payable each 31 December. Assume that Sable’s going rate of interest for this type of debt was 8%. The accounting period ends 31 December.

Required:

1. Give the entry to record the purchase on 1 January 20X5. Show computations (round to the nearest dollar).

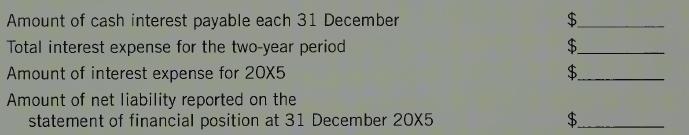

2. Complete the following tabulation:

3. Give the entries at each year-end for Sable.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: