Saturn Ltd. began operations in 20X3. For the first six years of operations, the company had the

Question:

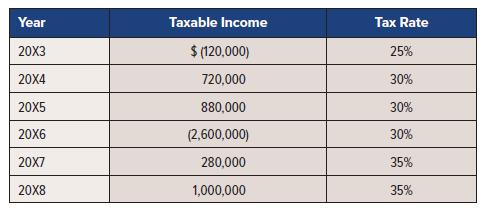

Saturn Ltd. began operations in 20X3. For the first six years of operations, the company had the following pre-tax net earnings (loss):

There have been no temporary differences between pre-tax accounting income and taxable income.

In all years, the probability of loss carryforward use was low.

Required:

For each year, prepare a journal entry or entries to record income tax expense (recovery).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: