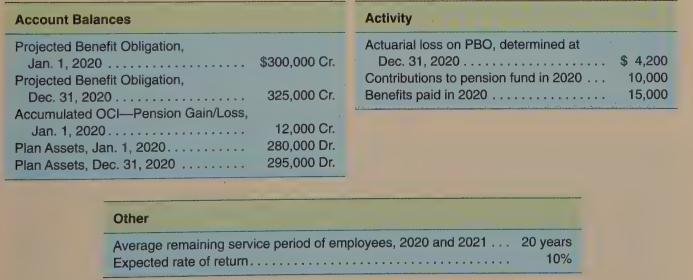

Spears Company presents the following information related to its pension plan for 2020, before recording pension expense.

Question:

Spears Company presents the following information related to its pension plan for 2020, before recording pension expense.

Required

a. Determine the amortization of Accumulated OCI-Pension Gain/Loss for 2020, using (1) corridor (minimum amortization) and (2) straight-line amortization based on average remaining service period.

b. Determine the Accumulated OCI—Pension Gain/Loss balance at January 1, 2021, assuming straight-line amortization.

c. Determine the impact on pension expense in 2020 based upon the information provided, assuming straightline amortization of accumulated pension gain/loss. What information is missing in order to calculate total pension expense?

d. Determine the amortization of Accumulated OCI—Pension Gain/Loss for 2021, assuming straight-line amortization.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781618533135

2nd Edition

Authors: Hanlon, Hodder, Nelson, Roulstone, Dragoo