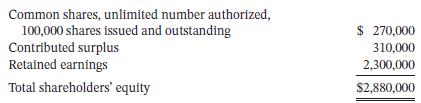

Stellar Corp. had the following shareholders equity on January 1, 2023: The contributed surplus arose from net

Question:

Stellar Corp. had the following shareholders’ equity on January 1, 2023:

The contributed surplus arose from net excess of proceeds over cost on a previous cancellation of common shares. Stellar prepares financial statements in accordance with ASPE.The following transactions occurred, in the order given, during 2023:

1. Subscriptions were sold for 12,000 common shares at $26 per share. The first payment was for $10 per share.

2. The second payment for the sale in item 1 above was for $16 per share. All payments were received on the second payment except for 2,000 shares.

3. In accordance with the subscription contract, which requires that defaulting subscribers have all their payments refunded, refund cheques were sent to the defaulting subscribers. At this point, common shares were issued to subscribers who had fully paid on the contract.

4. Repurchased 22,000 common shares at $29 per share. They were then retired.

5. Sold 5,000 preferred shares and 3,000 common shares together for $300,000. The common shares had a fair value of $31 per share.

Instructions

a. Prepare the journal entries to record the transactions for the company for 2023.

b. Assume that the subscription contract states that defaulting subscribers forfeit their first payment. Prepare the journal entries for items 2 to 4 above. Round to two decimal places when calculating average price per share.

c. Discuss how Stellar may have determined the fair value of its common shares, given that the company prepares financial statements in accordance with ASPE and is a private company.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy