The following three cases are independent. Case A On 31 December 20X7, a company has the following

Question:

The following three cases are independent.

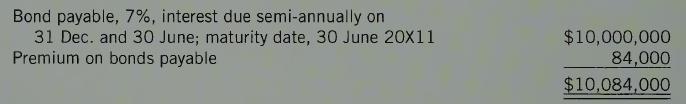

Case A On 31 December 20X7, a company has the following bond on the statement of financial position:

On 28 February 20X8, 20% of the bond was retired for \($2,200,000\) plus accrued interest to 28 February. Interest was paid on this date only for the portion of the bonds that were retired. Premium amortization was recorded on this date in the amount of \($800,\) representing amortization on the retired debt only.

Required:

Provide the entries to record the bond interest on 28 February and the bond retirement.

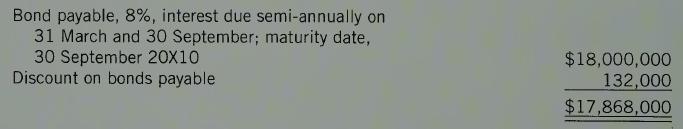

Case B On 31 December 20X7, Devon Company has the following bond on the statement of financial position:

Accrued interest payable of \($360,000\) was recorded on 31 December 20X7 (\($18\) million X 8% X 3/12) and the bond discount was correctly amortized to 31 December 20X7. On 31 March 20X8, semi-annual interest was paid and the bond discount was amortized by a further \($12,000.\) Then, 40% of the bond was retired at a cost of \($7,030,000\) (exclusive of interest).

Required:

Provide the entries to record the bond interest and retirement on 31 March 20X8.

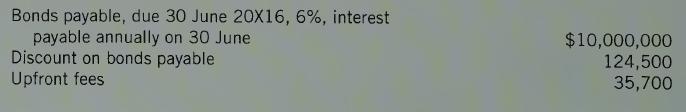

Case C At 31 December 20X3, Happy Ltd reports the following on its statement of financial position:

Accrued interest payable of \($300,000\) was recorded on 31 December 20X3 (\($10\) million X 6% X 6/12) and the bond discount was correctly amortized to 31 December 20X3. On 1 March 20X4, 80% of the bond issue was bought back in the open market and retired at 99 plus accrued interest.

Required:

Provide the entries to record the interest and the retirement. Record interest and amortization only on the portion of the bond that is retired on 1 March 20X4; amortization of \($381\) must be recorded for the upfront costs and \($1,328\) on the discount.

Step by Step Answer: