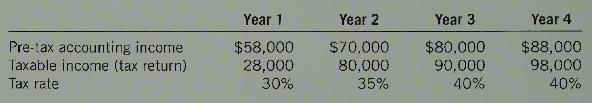

The records of Morgan Corporation provided the following data at the end of years 1 through 4

Question:

The records of Morgan Corporation provided the following data at the end of years 1 through 4 relating to income tax allocation:

The above amounts include only one temporary difference; no other changes occurred. At the end of year 1 , the company prepaid an expense of \(\$ 30,000\), which was then amortized for accounting purposes over the next three years (straight-line). The full amount was included as a deduction in year 1 for income tax purposes. Each year's tax rate was enacted in each specific year-that is, the year 2 tax rate was enacted in year 2 , etc.

The above amounts include only one temporary difference; no other changes occurred. At the end of year 1 , the company prepaid an expense of \(\$ 30,000\), which was then amortized for accounting purposes over the next three years (straight-line). The full amount was included as a deduction in year 1 for income tax purposes. Each year's tax rate was enacted in each specific year-that is, the year 2 tax rate was enacted in year 2 , etc.

Required:

1. Calculate income tax payable for each year.

2. Calculate income tax expense.

3. Comment on the effect that use of the liability method has on income tax expense when the income tax rate changes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: