Question:

Tollmark Ltd. (Tollmark) is a private company founded 20 years ago by Karam Raynan. The company is in the medical supply industry, providing medical equipment to hospital and doctors offices. Tollmark’s main focus has been major cities across Canada; however, the company is quickly expanding into all the U.S. market as well. Karam is the president of Tollmark and majority shareholder with 55% of the common shares. Tollmark has three other investors that are not involved in the day to day operations. Each investor owns 15% of the 1.5 million common shares of Tollmark. Each owner purchased their shares for an average purchase price of $8 / share. Tollmark is currently in a period of expansion, and as a result, has entered into a number of transactions to raise additional capital during the year. The proceeds are being used to expand its current manufacturing facility in order to keep up with increased production, as well as expand the sales team.

It is currently 30 November 20X1 and Karam has hired your accounting firm to assist with preparing the 20X1 financial statements. In particular, Karam wants your assistance understanding the overall the impact on the financial statements of Tollmark. He has asked that you summarize the impact on the shareholders’ equity, and has provided you with information about the transactions in question (Exhibit 1). As required by the shareholder agreement, Tollmark prepares their financial statements in accordance with IFRS.

Karam has also asked for your advice on how the company should track all of these transactions, including what type of information and records should be kept relating to the new shares that are, or will soon be, issued.

Required:

Prepare a report.

Transcribed Image Text:

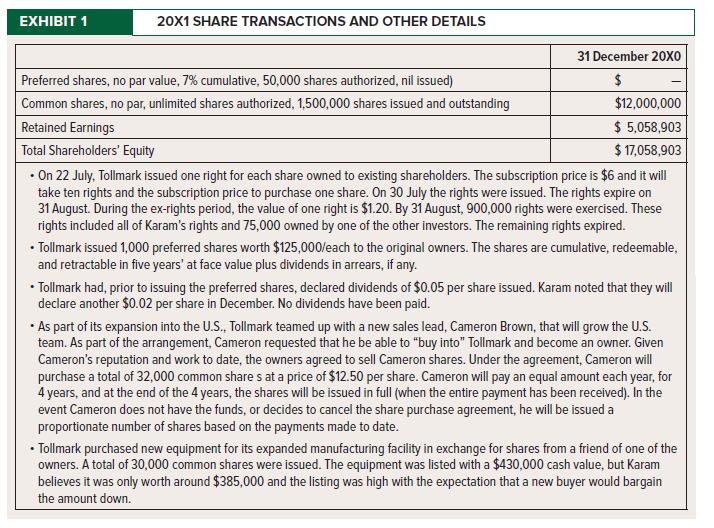

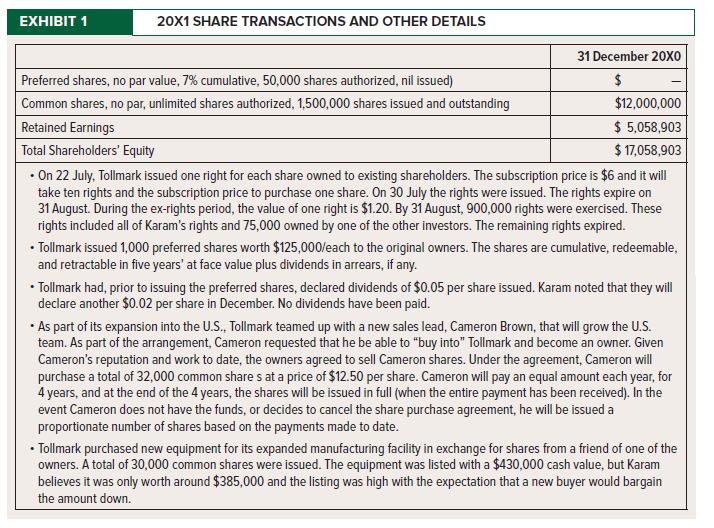

EXHIBIT 1

20X1 SHARE TRANSACTIONS AND OTHER DETAILS

Preferred shares, no par value, 7% cumulative, 50,000 shares authorized, nil issued)

Common shares, no par, unlimited shares authorized, 1,500,000 shares issued and outstanding

Retained Earnings

Total Shareholders' Equity

31 December 20X0

$

$12,000,000

$ 5,058,903

$ 17,058,903

• On 22 July, Tollmark issued one right for each share owned to existing shareholders. The subscription price is $6 and it will

take ten rights and the subscription price to purchase one share. On 30 July the rights were issued. The rights expire on

31 August. During the ex-rights period, the value of one right is $1.20. By 31 August, 900,000 rights were exercised. These

rights included all of Karam's rights and 75,000 owned by one of the other investors. The remaining rights expired.

• Tollmark issued 1,000 preferred shares worth $125,000/each to the original owners. The shares are cumulative, redeemable,

and retractable in five years' at face value plus dividends in arrears, if any.

• Tollmark had, prior to issuing the preferred shares, declared dividends of $0.05 per share issued. Karam noted that they will

declare another $0.02 per share in December. No dividends have been paid.

As part of its expansion into the U.S., Tollmark teamed up with a new sales lead, Cameron Brown, that will grow the U.S.

team. As part of the arrangement, Cameron requested that he be able to "buy into" Tollmark and become an owner. Given

Cameron's reputation and work to date, the owners agreed to sell Cameron shares. Under the agreement, Cameron will

purchase a total of 32,000 common share s at a price of $12.50 per share. Cameron will pay an equal amount each year, for

4 years, and at the end of the 4 years, the shares will be issued in full (when the entire payment has been received). In the

event Cameron does not have the funds, or decides to cancel the share purchase agreement, he will be issued a

proportionate number of shares based on the payments made to date.

• Tollmark purchased new equipment for its expanded manufacturing facility in exchange for shares from a friend of one of the

owners. A total of 30,000 common shares were issued. The equipment was listed with a $430,000 cash value, but Karam

believes it was only worth around $385,000 and the listing was high with the expectation that a new buyer would bargain

the amount down.