(Two Temporary Differences, Tracked through 3 Years, Multiple Rates) Taxable income and pretax financial income would be...

Question:

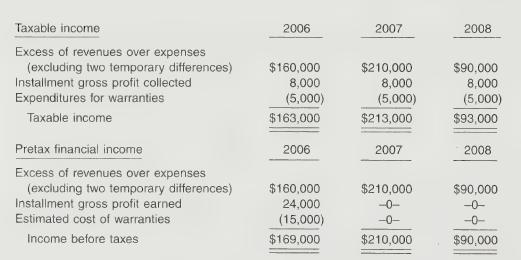

(Two Temporary Differences, Tracked through 3 Years, Multiple Rates) Taxable income and pretax financial income would be identical for Huber Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared.

The tax rates in effect are: 2006, 40%; 2007 and 2008, 45%. All tax rates were enacted into law on January 1, 2006. No deferred income taxes existed at the beginning of 2006. Taxable income is expected in all future years.

Instructions Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2006, 2007, and 2008.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield