Watson Corporation, which uses IFRS, is using the indirect method to prepare its 2023 statement of cash

Question:

Watson Corporation, which uses IFRS, is using the indirect method to prepare its 2023 statement of cash flows and chooses to classify dividends paid as financing activities and interest paid as operating activities on the statement of cash flows. A list of items that may affect the statement follows:_____ a. Increase in accounts receivable_____ b. Decrease in accounts receivable_____ c. Issue of shares_____ d. Depreciation expense_____ e. Sale of land at carrying amount_____ f. Sale of land at a gain_____ g. Payment of dividends charged to retained earnings_____ h. Purchase of land and building_____ i. Purchase of long-term investment in bonds, reported at amortized cost_____ j. Increase in accounts payable_____ k. Decrease in accounts payable_____ l. Loan from bank by signing note payable_____ m. Purchase of equipment by issuing a note payable_____ n. Increase in inventory_____ o. Issue of bonds_____ p. Retirement of bonds_____ q. Sale of equipment at a loss_____ r. Purchase of corporation’s own shares_____ s. Acquisition of equipment using a finance lease_____ t. Conversion of bonds payable into common shares_____ u. Goodwill impairment loss_____ v. Interest paid on self-constructed building

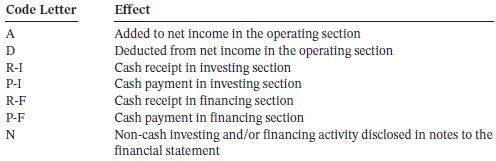

Match each code in the list that follows to the items above to show how each item will affect Watson’s 2023 statement of cash flows. Unless stated otherwise, assume that the transaction was for cash.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119740445

13th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy