As of January 1, 2019, Microbyte Computer Company began a defined benefit pension plan that covers all

Question:

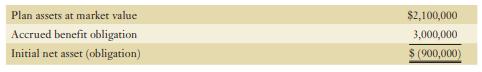

As of January 1, 2019, Microbyte Computer Company began a defined benefit pension plan that covers all 300 of its employees. Employment levels have remained constant and are expected to remain so in the future. Prior to 2019, rather than having a defined benefit plan, the company had a defined contribution plan that had accumulated assets of $2,100,000 at market value. All employees were retroactively grandfathered as to the defined benefit entitlements they would receive under the new plan (i.e., the employees had been participating in the defined contribution plan and are now part of the defined benefit plan). The company’s insurance company, which is administering the pension plan, determined the following values effective on January 1, 2019:

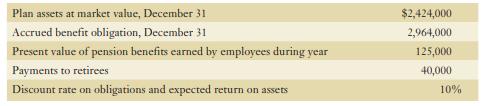

The company’s funding policy is to contribute annually on December 31 at a rate of 15% of covered employees’ payroll. The annual payroll of employees covered by the pension plan amounted to $2,500,000 in 2019. Assume that all other cash flows as well as expense accruals occur on the last day of the year.

The insurance company provided the following information for 2019:

Required:

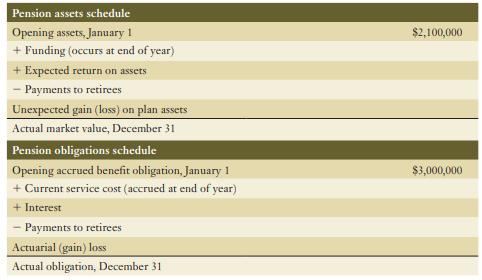

a. Using the above information, complete the missing information in the note disclosures reconciling the opening and closing positions of pension assets and liabilities for 2019.

b. Calculate the pension expense to be recognized in 2019 and show the individual components making up the pension expense.

b. Calculate the pension expense to be recognized in 2019 and show the individual components making up the pension expense.

c. Record the journal entries for Microbyte’s pension in 2019. Use separate accounts for each item of pension expense and OCI.

Step by Step Answer: