Assume the facts given in BE6.33 for Darwin Corporation. Assume billings for the construction contract were as

Question:

Assume the facts given in BE6.33 for Darwin Corporation. Assume billings for the construction contract were as follows: 2020, $500,000; 2021, $2 million; and 2022, $1.7 million. Calculate the balance of the Contract Asset/Liability account at the end of each year using

(a) The percentage-of completion method

(b) The zero-profit and completed-contract methods.

BE6.33

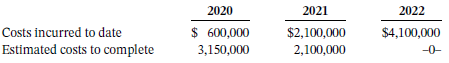

During 2020, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms of the contract, Darwin sends billings as revenues are earned. Billings are non refundable. The following information is available:

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy