Aston Corporation performs year-end planning in November of each year before its calendar year ends in December.

Question:

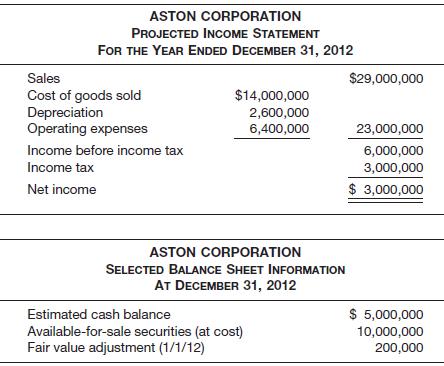

Aston Corporation performs year-end planning in November of each year before its calendar year ends in December. The preliminary estimated net income is $3 million. The CFO, Rita Warren, meets with the company president, J. B. Aston, to review the projected numbers. She presents the following projected information.

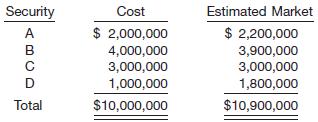

Estimated market value at December 31, 2012:

Other information at December 31, 2012:

Equipment $ 3,000,000

Accumulated depreciation (5-year SL) 1,200,000

New robotic equipment (purchased 1/1/12) 5,000,000

Accumulated depreciation (5-year DDB) 2,000,000

The corporation has never used robotic equipment before, and Warren assumed an accelerated method because of the rapidly changing technology in robotic equipment. The company normally uses straight-line depreciation for production equipment.

Aston explains to Warren that it is important for the corporation to show a $7,000,000 income before taxes because Aston receives a $1,000,000 bonus if the income before taxes and bonus reaches $7,000,000. Aston also does not want the company to pay more than $3,000,000 in income taxes to the government.

Instructions

(a) What can Warren do within GAAP to accommodate the president’s wishes to achieve the $7,000,000 in income before taxes and bonus? Present the revised income statement based on your decision.

(b) Are the actions ethical? Who are the stakeholders in this decision, and what effect do Warren’s actions have on their interests?

Step by Step Answer: