Bidwell Leasing purchased a single-engine plane for its fair value of $645,526 and leased it to Red

Question:

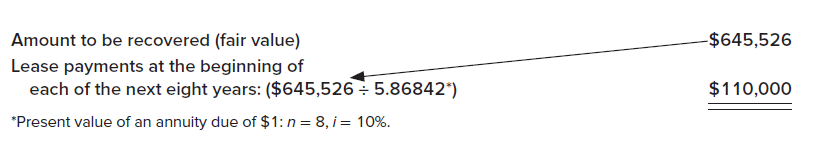

Bidwell Leasing purchased a single-engine plane for its fair value of $645,526 and leased it to Red Baron Flying Club on January 1, 2021.Terms of the lease agreement and related facts werea. Eight annual payments of $110,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 through 2027. Red Baron knows that Bidwell Leasing?s implicit interest rate was 10%. The estimated useful life of the plane is eight years. Payments were calculated as follows:

b. Red Baron?s incremental borrowing rate is 11%.c. Incremental costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $18,099.

Required:1. How should this lease be classified (a) by Bidwell Leasing (the lessor) and (b) by Red Baron (the lessee)?2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021.3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club.4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term.5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing.6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation or amortization.7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment).

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas