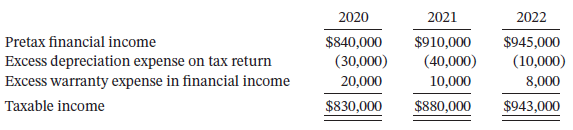

Button Company has the following two temporary differences between its income tax expense and income taxes payable.

Question:

Button Company has the following two temporary differences between its income tax expense and income taxes payable.

The income tax rate for all years is 20%.

Instructions

a. Assuming there were no temporary differences prior to 2020, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020, 2021, and 2022.

b. Indicate how deferred taxes will be reported on the 2022 balance sheet. Button?s product warranty is for 12 months.

c. Prepare the income tax expense section of the income statement for 2022, beginning with the line ?Pretax financial income.?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted: