Cardiff Corporation is a public company traded on a major exchange. Cardiff s common shares are currently

Question:

Cardiff Corporation is a public company traded on a major exchange. Cardiff ’s common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four shares would receive a fifth share). The board is wondering how shareholders’ equity would be affected, and whether the value of the typical shareholder’s investment will change.

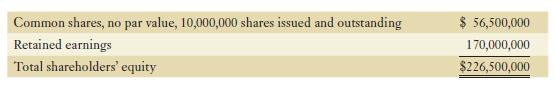

Details of Cardiff ’s equity section of the balance sheet is as follows:

Required:

a. At what price would you expect the shares to trade after either transaction? Explain with calculations.

b. Show what the equity section of the balance sheet for Cardiff would look like after the stock dividend. Do the same for the stock split alternative.

c. Assume that an investor has 4,000 common shares before the stock dividend or stock split. What would be the value of the investor’s holdings before and after the stock dividend or stock split?

d. What is your recommendation to the board of directors?

Step by Step Answer: