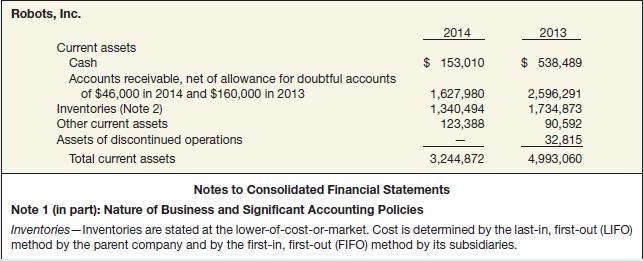

Question: Case 1 Robots, Inc. Robots, Inc. reported the following information regarding 20132014 inventory. Instructions (a) Why might Robots, Inc., use two different methods for valuing

Case 1 Robots, Inc.

Robots, Inc. reported the following information regarding 2013–2014 inventory.

Instructions

(a) Why might Robots, Inc., use two different methods for valuing inventory?

(b) Comment on why Robots, Inc., might disclose how its LIFO inventories would be valued under FIFO.

(c) Why does the LIFO liquidation reduce operating costs?

(d) Comment on whether Robots, Inc. would report more or less income if it had been on a FIFO basis for all its inventory.

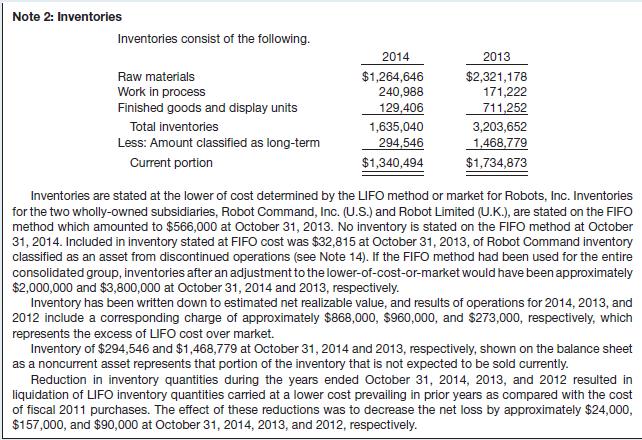

Case 2 Barrick Gold Corporation

Barrick Gold Corporation, with headquarters in Toronto, Canada, is the world’s most profitable and largest gold mining company outside South Africa. Part of the key to Barrick’s success has been due to its ability to maintain cash flow while improving production and increasing its reserves of gold-containing property. In the most recent year, Barrick achieved record growth in cash flow, production, and reserves.

The company maintains an aggressive policy of developing previously identified target areas that have the possibility of a large amount of gold ore, and that have not been previously developed. Barrick limits the riskiness of this development by choosing only properties that are located in politically stable regions, and by the company’s use of internally generated funds, rather than debt, to finance growth.

Barrick’s inventories are as follows.

Instructions

(a) Why do you think that there are no finished goods inventories? Why do you think the raw material, ore in stockpiles, is considered to be a non-current asset?

(b) Consider that Barrick has no finished goods inventories. What journal entries are made to record a sale?

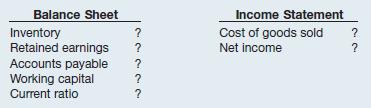

(c) Suppose that gold bullion that cost $1.8 million to produce was sold for $2.4 million. The journal entry was made to record the sale, but no entry was made to remove the gold from the gold in process inventory. How would this error affect the following?

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

a Robots Inc may use two different methods for valuing inventory because different methods can provi... View full answer

Get step-by-step solutions from verified subject matter experts