Coffin Corporation appropriately uses the installment-sales method of accounting to recognize income in its financial statements. The

Question:

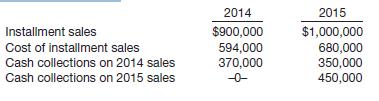

Coffin Corporation appropriately uses the installment-sales method of accounting to recognize income in its financial statements. The following information is available for 2014 and 2015.

Instructions

(a) Compute the amount of realized gross profit recognized in each year.

(b) Prepare all journal entries required in 2015.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118147290

15th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Income statements for Gaidar Company for 2014 and 2015 follow. Required Round all percentages to one decimal point. a. Perform a horizontal analysis, showing the percentage change in each income...

-

The following information is available for Best Appliance Inc.: Required Calculate the times interest earned ratio for 2014 and compare it to the industry average in Exhibit 18.11. Explain why it...

-

The following information is available for Washington Mills Corp. for 2012. Cash used to purchase treasury stock .............$ 48,100 Cash dividends paid .....................21,800 Cash paid for...

-

Management is responsible for establishing effective internal control for its organization, including measures to prevent, deter, and detect fraud. Appendix 7A on pages 294296 describes antifraud...

-

In the calculation of the standard deviation, what are the differences between each data value and the mean squared before they are summed? What would happen in every distribution of data if these...

-

Hillside issues $4,000,000 of 6%, 15-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31. The bonds are issued at a price of $3,456,448. Required 1. Prepare...

-

For which decision environment is linear programming most suited? LO.1

-

Recording the Effects of Adjusting Entries and Reporting a Corrected Income Statement and Balance Sheet On December 31, 2011, the bookkeeper for Grillo Company prepared the following income statement...

-

Jean works for A&R Law Firm. A&R pays (reimburses) Jean $260 per month for parking at work. How much does Jean need to include per month in her gross income related to the parking reimbursement? A)...

-

Goldstein Semiconductors experienced the following activity in its Photolithography Department during December. Materials are added at the beginning of the photolithography process. Units: Work in...

-

Berstler Construction Company began operations in 2014. Construction activity for the first year is shown below. All contracts are with different customers, and any work remaining at December 31,...

-

Swift Corp., a capital goods manufacturing business that started on January 4, 2014, and operates on a calendar-year basis, uses the installment-sales method of profit recognition in accounting for...

-

A small model car with mass m travels at constant speed on the inside of a track that is a vertical circle with radius 5.00 m (Fig. E5.45). If the normal force exerted by the track on the car when it...

-

How do intersectionality and identity salience intersect within the framework of diversity and inclusion initiatives, and what strategies can organizations employ to address these complexities ?

-

(a) -2-3 3. Evaluate the following determinants: 3 5 (b) |- 58 -8 -2 4 312 4 3 0 (c) 2 245 (d) 3 1 2 245 5 -1 -4

-

The following information pertains to the inventory of Parvin Company for Year 3: January 1 April 1 October 1 Beginning inventory 400 units @ $22 Purchased 2,600 units @ $27 Purchased 1,200 units @...

-

Using partial fraction decomposition to find the partial fractions of the function 26x2 +270x+404 f(x) = f(x) = 30x3 20x2-330x 280 Hint: The denominator of f(x) can be factored as (3x+7) (5x+5)(2x-8)...

-

Question 1: How do strategy and tactical action relate to each other in an organization? Question 2: How can you improve the implementation of strategy in this business organization?...

-

Use the fact that the trigonometric functions are periodic to find the exact value of each expression. Do not use a calculator. csc 450

-

Given that all the choices are true, which one concludes the paragraph with a precise and detailed description that relates to the main topic of the essay? A. NO CHANGE B. Decades, X-ray C. Decades...

-

IFRS prohibits the use of the completed-contract method in accounting for long-term contracts. If revenues and costs are difficult to estimate, how must companies account for long-term contracts?

-

At December 31, 2012, Fell Corporation had a deferred tax liability of $680,000, resulting from future taxable amounts of $2,000,000 and an enacted tax rate of 34%. In May 2013, a new income tax act...

-

How are deferred tax assets and deferred tax liabilities reported on the statement of financial position under IFRS?

-

BUS 280 Week 9 Assignment This week the assignment is about financial management. You will prepare a Cash Flow Statement for Clark's Sporting Goods and then you will calculate ratios for Sam's Paint...

-

Ayayai Restaurant's gross payroll for April is $46,800. The company deducted $2,551 for CPP$739 for Eland $9,026 for income taxes from the employeeschequesEmployees are paid monthly at the end of...

-

44. Dryer Companys policy is to keep 25% of the next month's sales in ending inventory. If Dryer meets its ending inventory policy at the end of April and sales are expected to be 24,000 units in May...

Study smarter with the SolutionInn App