Corning-Howell reported taxable income in 2021 of $120 million. At December 31, 2021, the reported amount of

Question:

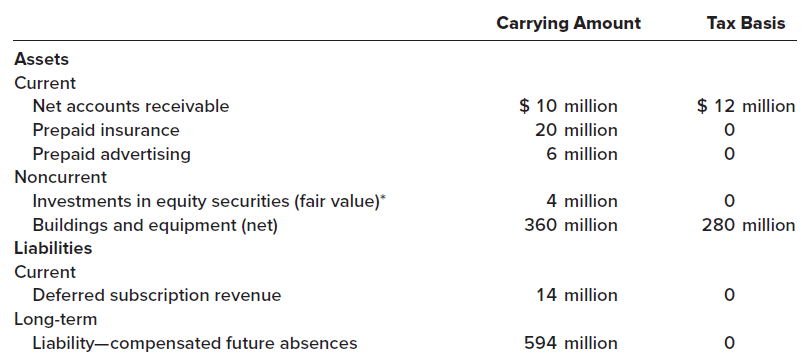

Corning-Howell reported taxable income in 2021 of $120 million. At December 31, 2021, the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below:

The total deferred tax asset and deferred tax liability amounts at January 1, 2021, were $156.25 million and $25 million, respectively. The enacted tax rate is 25% each year.

Required:1. Determine the total deferred tax asset and deferred tax liability amounts at December 31, 2021.2. Determine the increase (decrease) in the deferred tax asset and deferred tax liability accounts at December 31, 2021.3. Determine the income tax payable currently for the year ended December 31, 2021.4. Prepare the journal entry to record income taxes for 2021.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas