Corus Manufacturing Ltd., a sailboat manufacturer, is preparing its financial statements for the year ended August 31,

Question:

Corus Manufacturing Ltd., a sailboat manufacturer, is preparing its financial statements for the year ended August 31, 2018. It is September 15 and your CFO presents you (the controller) with a list of issues that require additional attention:

i. The company repurchased 100,000 common shares at $17/share on March 31, 2018. Of these, 70,000 were put into treasury and the remainder were cancelled.

ii. Corus has a stock option plan for its management team. At the beginning of fiscal year 2018, the company had outstanding 200,000 stock options with an exercise price of $12; the value of these options at the grant date was $1.50 per option. On April 30, 2018, 150,000 of these options were exercised and 50,000 expired. The company used treasury shares to supply the shares for the stock option exercises.

iii. On May 1, 2018, the company granted to management employees another 50,000 stock options for services to be rendered from the grant date until April 30, 2020. These options had an exercise price of $18, vest with the employees on April 30, 2022, and expire on April 30, 2027. These options had an estimated fair value of $2.40 per option on the grant date.

iv. Corus had a two-for-one stock split on May 31, 2018. Relevant conditions of convertible securities and stock options were adjusted for this split.

v. The company issued long-term bonds to a group of private investors. The bonds were issued on June 30, 2018, had maturity value of $20 million on June 30, 2024, and pay semi-annual interest at a rate of 7% per year. Each $1,000 bond is convertible into 50 common shares. Proceeds of the issuance were $21.5 million. Without the conversion feature, the bond would have been priced to yield 8% per annum, resulting in proceeds of $18,640,967.

The company had net income of $10.5 million for fiscal 2018, a tax rate of 30%, and $16 average stock price.

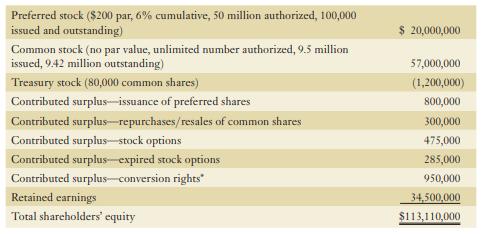

The equity section of the company’s balance sheet on August 31, 2017 (end of the prior fiscal year), showed the following:

* The bonds with these conversion rights were issued in fiscal 2008, had face value of $5 million and coupon payments of 8% per year payable semi-annually, yielded 6%, and mature on September 30, 2022. Each $100 bond is convertible into 10 common shares. On April 1, 2018, all of these bonds were converted into common shares.

Required:

a. Record the repurchase of 100,000 shares on March 31, 2018. Use the number of shares issued (rather than outstanding) to compute any per share amounts of contributed surplus.

b. Compute the April 1, 2018 carrying value of the debt portion of the convertible bond issued in fiscal 2008.

c. Record the conversion of the $5 million of bonds into common shares on April 1, 2018. Use the book value method.

d. Record the exercise of stock options and the related sale of treasury shares on April 30, 2018.

e. Record the entry to reflect stock option expiration on April 30, 2018.

f. Record the issuance of stock options on May 1, 2018.

g. Record the $20 million security issuance of bonds on June 30, 2018.

h. Show in good form the equity section of the balance sheet for Corus as at August 31, 2018.

Step by Step Answer: