Crosley Corp. sold an investment on an installment basis. The total gain of $60,000 was reported for

Question:

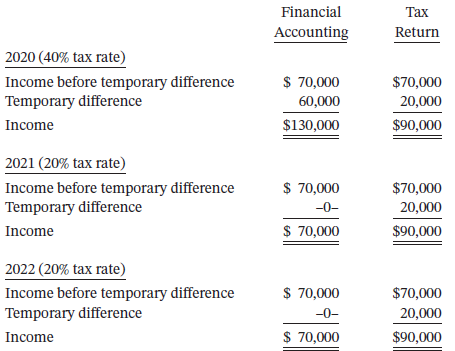

Crosley Corp. sold an investment on an installment basis. The total gain of $60,000 was reported for financial reporting purposes in the period of sale. The company qualifies to use the installment-sales method for tax purposes. The installment period is 3 years; one-third of the sale price is collected in the period of sale. The tax rate was 40% in 2020, and 20% in 2021 and 2022. The 20% tax rate was not enacted in law until 2021. The accounting and tax data for the 3 years is shown below.

Instructions

a. Prepare the journal entries to record the income tax expense, deferred income taxes, and the income taxes payable at the end of each year. No deferred income taxes existed at the beginning of 2020.

b. Explain how the deferred taxes will appear on the balance sheet at the end of each year.

c. Draft the income tax expense section of the income statement for each year, beginning with ?Income before income taxes.?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel