Dayton Products Ltd. has a separate pension plan for its management. This pension plan was put in

Question:

Dayton Products Ltd. has a separate pension plan for its management. This pension plan was put in place on January 1, 2010. The plan initiation created a pension obligation of $3 million. However, only $1 million was put into the plan initially. On January 1, 2020, the company improved the benefits for the plan, which increased the actuarial obligation by $750,000.

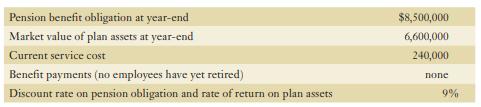

The pension plan’s trustee and actuary provided the following information for the fiscal year ended December 31, 2020:

Financial statements for the pension trust show that, as at December 31, 2019, plan assets were $5.4 million and the pension obligation was $7.2 million.

The accounting department’s records indicate that $250,000 was contributed into the pension fund during 2020.

For purposes of interest calculations, management assumes that all accruals and cash flows occur at the beginning of the fiscal year.

Required:

a. Prepare the schedules showing the movements in the pension assets and liabilities during fiscal 2020.

b. Derive the pension expense for the fiscal year ended December 31, 2020. Please show your work.

c. Record the journal entries relating to the pension plan for the 2020 fiscal year.

Step by Step Answer: