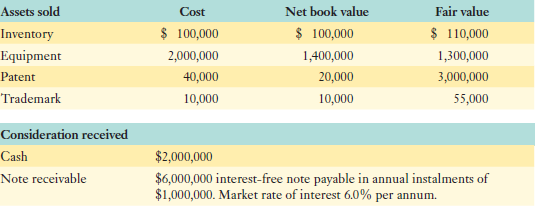

Dudas Inc. sold a division of its business in 2017. Pertinent details follow: Required: Prepare the journal

Question:

Required:

Prepare the journal entry to record the sale of the assets assuming that Dudas Inc. uses the net method to record intangibles. Segregate the gain or loss on the sale into its component parts, for example, arising from the sale of the patent.

Transcribed Image Text:

Net book value $ 100,000 Fair value $ 110,000 1,300,000 3,000,000 55,000 Assets sold Cost $ 100,000 2,000,000 40,000 10,000 Inventory Equipment 1,400,000 20,000 10,000 Patent Trademark Consideration received $2,000,000 $6,000,000 interest-free note payable in annual instalments of $1,000,000. Market rate of interest 6.0% per annum. Cash Note receivable

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (21 reviews)

We must first determine the cash equivalent sales price using present value techniques and then allo...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Sandhawalia Inc. (SI) sold a division of its business in 2017 for $2,700,000 cash and a $1,800,000, 4% note repayable in annual installments of $495,882. The interest rate charged approximated the...

-

On November 4, 2017, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2017 and 2018, respectively, Blue took $642 and $5,128 of cost...

-

On November 4, 2017, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2017 and 2018, respectively, Blue took $642 and $5,128 of cost...

-

In Exercises 1318, find the average rate of change of the function from x 1 to x 2 . f(x) = 3x from x 0 to x = 5

-

An object is placed a distance r in front of a wall, where r exactly equals the radius of curvature of a certain concave mirror. At what distance from the wall should this mirror be placed so that a...

-

. Please answer the questions asked for only UAVEV is a small-scale contract producer and seller of microchips for unmanned aerial vehicles (UAVs) and electric vehicles (EVs). The master budget will...

-

Discuss how customers evaluate proposals

-

The intangible assets section of Willingham Company at December 31, 2014, is presented below. Patents ($100,000 cost less $10,000 amortization) ...... $ 90,000 Copyrights ($60,000 cost less $24,000...

-

QUESTION 1 5 points Krista and Sammie came across this opportunity to open up a Poke restaurant. The initial investment is anywhere in the low $90K to $205K. Looking at the possibilities in the...

-

Selena Maranjian invests the following sums of money in common stocks having expected returns as follows: a. What is the expected return (percentage) on her portfolio? b. What would be her expected...

-

Axo Mirth Company paid $24 million to purchase a drug patent on April 1, 2013. At the date of purchase, the patent remained valid for another 12 years. In 2015, the company spent $4 million to...

-

Determine the amount of accounting goodwill or other amounts by completing the table below. ($000's) Cash Carrying value 7,000 Fair value 7,000 40,000 31,000 Accounts receivable 43,000 Inventories...

-

Bafana Sales and Service received these amounts during July 20x4: 1 From receivable, A. French, R1 080. 3 From receivable, L. Gandhi, R2 190. 4 Cash for services rendered, R1 881. 7 From receivable,...

-

Alvarado Company produces a product that requires 5 standard direct labor hours per unit at a standard hourly rate of $12.00 per hour. If 5,700 units used 29,400 hours at an hourly rate of $11.40 per...

-

7. (30 points) You are a teaching assistant (TA) for a new course in the department and you wish to measure the amount of time that students spend engaging with the online resources. Using the Canvas...

-

Mod Clothiers makes women's clothes. It costs $28,000 to produce 5,000 pairs of polka-dot polyester pants. They have been unable to sell the pants at their usual price of $50.00. The company is...

-

In a mid-sized manufacturing company, the annual financial statements were prepared for audit by an external auditing firm. The company\'s finance team had diligently compiled the financial data, and...

-

Explain the meaning of the SMART acronym. In 100-200 words, define what the words "goal" and "success" mean to you. Summarize your thoughts on whether or not the SMART model can help you become a...

-

Solve the right triangles with the given parts. Refer to Fig. 4.68. A = 37.5, a = 12.0 A C b Fig. 4.68 B a C

-

Highland Theatre is owned by Finnean Ferguson. At June 30, 2014, the ledger showed the following: Cash, $6,000; Land, $100,000; Buildings, $80,000; Equipment, $25,000; Accounts Payable, $5,000;...

-

Select transactions and other information pertaining to Bedford Whale Watching Ltd. (BWW) are detailed below. Facts: a. BWW is domiciled in Bedford, Nova Scotia, and all purchases and sales are made...

-

Elgin Company had the following shareholders equity account balances on December 31, 2021: During 2022, the following transactions occurred: i. May 1: Elgin resold 800 of the treasury shares at $48...

-

Cornwall has a defined benefit pension plan. The companys balance sheet shows a defined benefit asset of $650,000 at year-end. This balance was composed of $22,800,000 of assets and $22,150,000 of...

-

Describe how the following affect the valuation of PPE. a) Cash Discounts b) Deferred Payment Contracts

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

Study smarter with the SolutionInn App