Evans Shielding Products (ESP) uses the aging method for its accounts receivable. On January 1, 2017, the

Question:

On January 1, 2017, ESP received a promissory note from a customer in exchange for a large purchase of goods from ESP. The note pays interest at 7% annually, matures on December 31, 2019, and will pay ESP $150,000 upon maturity. The market yield for this type of note is 10%.

During 2017, ESP factored $200,000 of its receivables without recourse for net proceeds of $186,000.

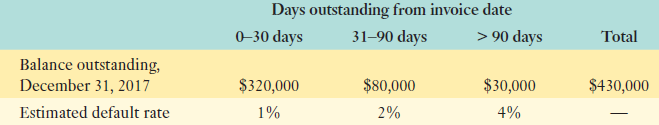

The following table is the aging schedule for ESP€™s receivables:

Required:

a. Determine ESP€™s bad debts expense for 2017.

b. Record the journal entry or entries relating to the factoring transaction.

c. Record the sale made in exchange for the promissory note.

d. For 2017, how much interest income should ESP record for the promissory note?

Aging schedule is an accounting table that shows a company’s account receivables. It is an summarized presentation of accounts receivable into a separate time brackets that the rank received based upon the days due or the days past due. Generally...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: