Fellows Inc., a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year

Question:

Fellows Inc., a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period, Fellows acquired common shares in Yukasato Inc. and Admin Importers.

In 2009, Fellows acquired 25% of Yukasato?s common shares for $588,000 and accounts for thisinvestment using the equity method. The book value of Yukasato?s net ?assets at the date of purchase was $1.8 million. The excess of the purchase price over the book value of the net assets relates to assets that are subject to amortization. These assets have a remaining life of 20 years. For its fiscal year ended November 30, 2020, Yukasato Inc. reported net income of $250,000 and paid dividends of $100,000.

In 2011, Fellows acquired 10% of Admin Importers? common shares for $204,000 and accounts for this investment using the FV-OCI model.

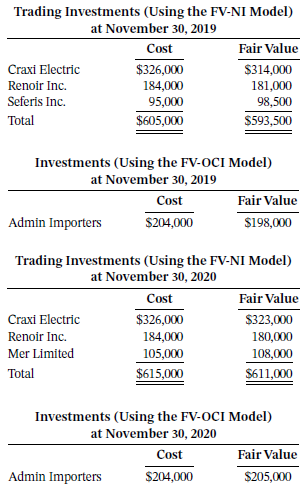

Fellows also has a policy of investing idle cash in equity securities to generate short-term profits. The following data are for Fellows? trading investment portfolio:

On November 14, 2020, Ted Yan was hired by Fellows as assistant controller. His first assignment was to prepare the entries to record the November activity and the November 30, 2020 year-end adjusting entries for the current trading investments and the investment in common shares of Admin Importers.

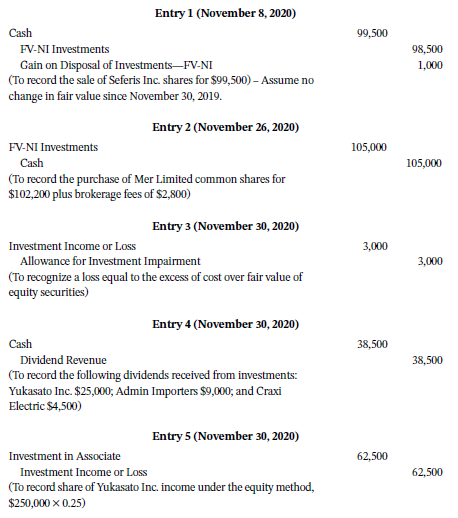

Using Fellows? ledger of investment transactions and the data given above, Yan proposed the following entries and submitted them to Julie O?Brien, controller, for review:

Instructions

a. The journal entries proposed by Ted Yan will establish the value of Fellows? equity investments to be reported on the company?s external financial statements. Review each journal entry and indicate whether it is in accordance with the applicable accounting standards. If an entry is incorrect, prepare the entry(ies) that should have been made.

b. Digging Deeper Because Fellows owns more than 20% of Yukasato Inc., Julie O?Brien has adopted the equity method to account for this investment. Under what circumstances would it be inappropriate to use the equity method to account for a 25% interest in the common shares of Yukasato Inc.? If the equity method is not appropriate in this case, what method would you recommend? Why?

c. Digging Deeper Are there any differences between the characteristics of trading investments accounted for using the FV-NI model and investments accounted for using the FV-OCI model in general? Explain. Are there any differences in the specific case of Fellows Inc.?s investments?

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy