For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired

Question:

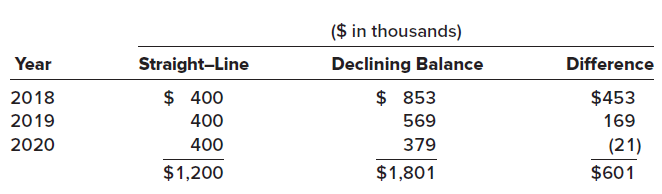

For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2018 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At the beginning of 2021, Clinton decides to change to the straight-line method.The effect of this change on depreciation for each year is as follows:

Required:1. Will Clinton apply the straight-line method retrospectively or apply the straight-line method prospectively?2. Prepare any 2021 journal entry related to the change.

($ in thousands) Declining Balance $ 853 Year Straight-Line Difference $ 400 $453 2018 569 2019 400 169 2020 400 379 (21) $1,801 $1,200 $601

Step by Step Answer:

Requirement 1 In general we report voluntary changes in accounting principles retrospectively Howeve...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

At Precision Custom Molds, manufacturing overhead was estimated to be $20,000,000 at the start of the year and direct labor hours were estimated to be 200,000. Overhead is applied to jobs using a...

-

On December 31, the warranty liability was estimated to be $100,000. On January 16 of the following year, results of a study done before December 31 were received. These study results indicate that...

-

On December 31, the warranty liability was estimated to be $100,000. On January 16 of the following year, it was learned that one week before, on January 9, poor-quality materials were introduced...

-

In Exercises verify the identity. coshx = 1 + cosh 2x 2

-

Explore these graphs, using a friendly window with a factor of 2 and -10 ( t ( 10. a. Graph x = t and y = |t|. b. Graph x = t - 1 and y = |t| + 2. How does this graph compare with the graph in 4a? c....

-

The managed effort by organizations to develop new products or services and/or new uses for existing products or services is called ______.

-

Profit of a production. The profit earned by a manufacturer after selling x products is shown in the following table. Production, x (in 00) Profit, y (in $000) 10 150 20 200 30 250 40 300 50 290 60...

-

In a study on the fertility of married women conducted by Martin O'Connell and Carolyn C. Rogers for the Census Bureau in 1979, two groups of childless wives aged 25 to 29 were selected at random and...

-

Rita Lane is the accountant for Outdoor Living, a manufacturer of outdoor furniture that is sold through specialty stores and Internet companies. Lane is responsible for reviewing the standard costs...

-

The Whitcomb Company manufactures a metal ring for industrial engines that usually weighs about 50 ounces. A random sample of 50 of these metal rings produced the following weights (in ounces). a....

-

In 2021, internal auditors discovered that PKE Displays, Inc., had debited an expense account for the $350,000 cost of a machine purchased on January 1, 2018. The machines useful life was expected to...

-

Refer to the situation described in BE 2010. Assume the error was discovered in 2023, after the 2022 financial statements are issued. Ignoring income taxes, what journal entry will PKE use to correct...

-

Of all individual tax returns filed in the United States during the 2009 tax filing season, 15.8% were prepared by H&R Block. For a randomly selected sample of 900 tax returns filed during this...

-

In the circuit of Fig. 4-51 write two loop equations using I 1 and I 2 . Then find the currents and node voltages. A 3A ( 4 3 V 792 B +1 D w 392 12 C

-

The capacitor in the circuit shown in Fig. 7-37 has initial charge Q 0 = 800 C, with polarity as indicated. If the switch is closed at t = 0, obtain the current and charge, for t > 0. 100 V (+ 10 4 F

-

A gift shop sells 400 boxes of scented candles a year. The ordering cost is \($60\) for scented candles, and holding cost is \($24\) per box per year. What is the economic order size for scented...

-

Kay Vickery is angry with Gene Libby. He is behind schedule developing supporting material for tomorrows capital budget committee meeting. When she approached him about his apparent lackadaisical...

-

Tharpe Painting Company is considering whether to purchase a new spray paint machine that costs \($3,000\) . The machine is expected to save labor, increasing net income by \($450\) per year. The...

-

Boxes containing 24 floor tiles are loaded into vans for distribution. In a load of 80 boxes there are, on average, three damaged floor tiles. Find, approximately, the probability that: a. There are...

-

Express mass density in kg/m3 and weight density in lb/ft3. 1. Find the mass density of a chunk of rock of mass 215 g that displaces a volume of 75.0 cm3 of water. 2. A block of wood is 55.9 in. x...

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

How does separating current assets from property, plant, and equipment in the balance sheet help analysts?

-

Los siguientes datos corresponden a las operaciones de Turk Company el ao pasado: Ventas $ 900 000 Utilidad operativa neta $ 36 000 Margen de contribucin $ 150 000 Activos operativos promedio $ 180...

-

Problem 16-16 Tax Shields (LO2) River Cruises is all-equity-financed with 53,000 shares. It now proposes to issue $280,000 of debt at an interest rate of 12% and to use the proceeds to repurchase...

-

In a process costing system, companies use predetermined overhead rates to apply overhead

Study smarter with the SolutionInn App