Question: In the text, we discussed the practical, step-by-step approach for the subsequent measurement of an operating lease for the lessee. However, that exact approach is

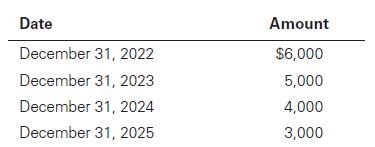

In the text, we discussed the practical, step-by-step approach for the subsequent measurement of an operating lease for the lessee. However, that exact approach is not specified by the Codification. Consider the following lease scenario. Baldwin Brokerage enters into a lease agreement with Hoyt Motors to lease an automobile with a fair value of $45,000 under a 5-year lease on December 20, 2021. The lease commences on January 1, 2022, and Baldwin will return the automobile to Hoyt on December 31, 2026. The automobile has an estimated useful life of 7 years. Baldwin made a lease payment of $5,000 on December 20, 2021. The lease agreement stipulates the following annual payments in addition to the December 20 payment:

The implicit rate of the lease is 9% and is known by Baldwin. There are no purchase option, no lease incentives, no residual value guarantees, and no transfer of ownership. Baldwin incurs initial direct costs of $2,000 prior to lease commencement. Determine whether Baldwin should classify the lease as an operating or finance lease. Provide all journal entries to be recorded by Baldwin (the lessee) over the lease term.

Required

a. Provide the journal entries that would be made over the lease term using the step-by-step approach provided in the text.

b. Research the Codification (Topic 842) and provide an analysis (with citations) as to what the Codification specifies as the approach to subsequent measurement.

c. Reconcile your answer in (a) to the approach specified in Topic 842 in the Codification.

Date December 31, 2022 December 31, 2023 December 31, 2024 December 31, 2025 Amount $6,000 5,000 4,000 3,000

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

a Baldwin the lessee can determine whether to classify the lease as an operating or a finance lease based on the Group I criteria We need to compute the present value of the lease payments in order to ... View full answer

Get step-by-step solutions from verified subject matter experts