Indicate the effect?Understate, Overstate, No Effect?that each of the following errors has on 2020 net income and

Question:

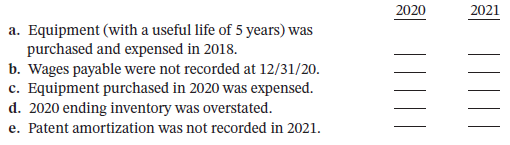

Indicate the effect?Understate, Overstate, No Effect?that each of the following errors has on 2020 net income and 2021 net income.

Transcribed Image Text:

2021 2020 a. Equipment (with a useful life of 5 years) was purchased and expensed in 2018. b. Wages payable were not recorded at 12/31/20. c. Equipment purchased in 2020 was expensed. d. 2020 ending inventory was overstated. e. Patent amortization was not recorded in 2021.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

2020 2021 a Overstated Overstated b Overstat...View the full answer

Answered By

Rustia Melrod

I am a retired teacher with 6 years of experience teaching various science subjects to high school students and undergraduate students. This background enables me to be able to help tutor students who are struggling with the science of business component of their education. Teaching difficult subjects has definitely taught me patience. There is no greater joy for me than to patiently guide a student to the correct answer. When a student has that "aha!" moment, all my efforts are worth it.

The Common Core standards are a useful yardstick for measuring how well students are doing. My students consistently met or exceeded the Common Core standards for science. I believe in working with each student's individual learning styles to help them understand the material. If students were struggling with a concept, I would figure out a different way to teach or apply that concept. I was voted Teacher of the Year six times in my career. I also won an award for Innovative Teaching Style at the 2011 National Teaching Conference.

4.90+

4+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted:

Students also viewed these Business questions

-

Indicate the effect of each of the following errors on a companys balance sheet and income statement of the current and succeeding years: a. The ending inventory is overstated. b. Merchandise...

-

Indicate the effect of each of the following errors on the following balance sheet and income statement items for the current and succeeding years: beginning inventory, ending inventory , accounts...

-

The auditors have determined that each of the following objectives will be part of the audit of SSC Corporation. For each audit objective, select a substantive procedure (see the list below) that...

-

Examples using activity-based costing generally show that traditional costing systems ________ high-volume, less complex products and ________ low-volume, complex products undercost; overcost...

-

The medicinal thermometer commonly used in homes can be read 0.1F, whereas those in the doctor's office may be accurate to 0.1C. In degrees Celsius, express the percent error expected from each of...

-

The subgroups are part of the change task force and they have to come up with a plan for the new organization. The plan should include how your newly merged organization should handle dress code,...

-

Discuss how you might conduct field research if researching the play patterns of children at home and in school. What particular problems would you encounter in gathering suitable data? What ethical...

-

Alamo Foods of San Antonio wants to introduce a new computer system for its perishable products warehouse. The costs and benefits are as follows: a. Given a discount rate of 8 percent (.08), perform...

-

Exercise 3-10 (Algo) Applying Overhead; Journal Entries; T-accounts [LO3-1, LO3-2] Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing...

-

Why is it necessary to convert accrual-based net income to cash-basis income when preparing a statement of cash flows?

-

On March 5, 2021, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department. While reviewing the company?s records for 2019 and...

-

Kathleen Cole Inc. acquired the following assets in January of 2018. Equipment, estimated service life, 5 years; salvage value , $15,000 $525,000 Building, estimated service life, 30 years; no...

-

Compute the area of the region bounded by the graph of f and the x-axis on the given interval. You may find it useful to sketch the region. f(x) = 16 - x 2 on [-4, 4]

-

Mixture of persuasive and negative formal I am Elizabeth grinderFirst part email Next part setting up the meeting Final part memo The reader is Robert * do not come off accusatory*** Project TWO:...

-

Anyone who has sampled today's social media offerings has probably experienced this situation: You find a few fascinating blogs, a few interesting people to follow on Twitter, a couple of podcast...

-

a. Begin with a converging lens of focal length f. Place an illuminated object a distance p, in front of the lens. For all positive values of p;: 1. calculate and sketch a graph of the location of...

-

Two firms are bidding for a $100 million contract in an all-pay auction. The bidding continues over many rounds, and each firm must incur a non-recoverable cost equal to 1% of the total value of the...

-

Illustrate the different steps required for the insertion of 58 followed by the deletion of 40 in the following AVL tree. 55 40 50 65 60 60 57 70 70

-

The following selected transactions were completed during August between Summit Company and Beartooth Co.: Aug. 1. Summit Company sold merchandise on account to Beartooth Co., $48,000, terms FOB...

-

d. The characteristic equation of a control system is given by s+2s+8s+12s+20s+16+16=0. Determine the number of the roots of the equation which lie on the imaginary axis of s-plane

-

The following information is available for Huntley Corporation's pension plan for the year 2013: Expected return on plan assets....................................$ 15,000 Actual return on plan...

-

The following information is available for Argust Corporation's pension plan for the 2013 fiscal year: Accrued benefit obligation, 1/1/13, accounting basis...............$315,000 Accrued benefit...

-

Griseta Limited sponsors a defined benefit pension plan for its employees, which it accounts for using the deferral and amortization approach under ASPE. The following data relate to the operation of...

-

Ferris Ltd. is a Canadian controlled private corporation. For the year ending December 31, 2019, its accounting Net Income Before Taxes, as determined under generally accepted accounting principles,...

-

If Faten accomplishes her projects with high-quality results, but takes more time than other managers in the process, as a manager she is ______. Select one: a. effective, but inefficient b....

-

Moore Corporation repurchased 3,700 shares of its own stock for $60 per share. The stock has a par of $15 per share. A month later Moore resold 925 shares of the treasury stock for $68 per share....

Study smarter with the SolutionInn App