Information from the shareholders' equity footnote for Mendes Manufacturing follows. Required Prepare the journal entries for 2017

Question:

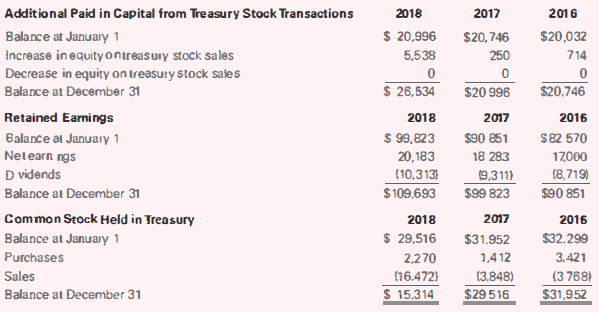

Information from the shareholders' equity footnote for Mendes Manufacturing follows.

Required

Prepare the journal entries for 2017 and 2018 to reflect the treasury stock transactions included in the preceding footnote information.

Transcribed Image Text:

Additional Paid in Capital from Treasury Stock Transactions 2018 2017 2016 $ 20,996 $20, 746 250 Balance at January 1 Increase in equity onireasuiy stock sales Decrease in equity on treasuty stock sales $20,032 5,538 714 $ 26,534 $20,746 Balance at December 31 $20 996 Retained Earnings 2018 2016 2017 s82 570 $ 99,823 Balance at January 1 Netearn ngs D vidends $90 851 20,183 18 283 17,000 (10,313 (8,719) 9,311) $99 823 Balance at December 31 $109,693 $90 851 Common Stock Held in Treasury 2017 2016 2018 $ 29,516 Balance at Januaiy 1 $32.299 $31.952 3.421 Purchases 2,270 1,4 12 (3,848) Sales (16.472} (3 768) $ 15,314 Balance at December 31 $29516 $31,952

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

Account 2018 2017 Debit Credit Debit Cre...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Information from the shareholders equity footnote for Mendes Manufacturing follows. Required Prepare the journal entries for 2015 and 2016 to reflect the treasury stock transactions included in the...

-

The information below is taken from the shareholders equity section of the statement of financial position for Harcus Cable: Required Provide the journal entries for the following: a. The issuance of...

-

Transactions related to Ives Companys shareholders equity (far left column) are listed in the following table. For each line you are provided with three choices of impact of the transaction on the...

-

Under a plan of complete liquidation, Coast Corporation distributes land with a $300,000 adjusted basis and a $400,000 FMV to William, a 25% shareholder. William has a $200,000 basis in his Coast...

-

A spaceship is moving at a constant velocity of 0.70c relative to an Earth observer. The Earth observer measures the length of the spaceship to be 40.0 m. How long is the spaceship as measured by its...

-

The diagram shows a sketch of the curve with equation The region R is bounded by the curve, the x-axis and the lines x = 1 and x = 3. Find the area of R. y = 3x + 6 x - 5, x > 0.

-

What can you do to make the work more meaningful for such a diverse group?(p. 93)

-

The 2018 income statement and comparative balance sheet of Sweet Valley, Inc. follow: SWEET VALLEY, INC. Income Statement Year Ended December 31, 2018 SWEET VALLEY, INC. Comparative Balance Sheet...

-

If Sheridan Company expects to sell 1,200 units of its product at $12 per unit, and break-even sales for the product are $12,240, what is the margin of safety ratio? Margin of safety ratio %

-

Write the mesh-current equations for the circuit in Fig. 3.117. 10 10 10 V 1) 10 15 V (+ 10 10 V 10 10 (+ 10 4 10 10 15 V (+ 10 +) 10 V

-

The stockholders' equity section of Siri Stores, lnc.'s balance sheet at December 31, 2017, follows: Stockholders' Equity Common Stock: no-par, $3 stated value, 80,000 shares authorized. 50,000...

-

On January 1, 2016, Pollo Company issued 1,000 shares of 4%, $100 par cumulative preferred stock for $110,000. On December 26, 2017, the board of directors declared dividends of $6,000, which were...

-

Determine which of the following are reducible over GF(2). a. \(x^{3}+1\) b. \(x^{3}+x^{2}+1\) c. \(x^{4}+1\) (be careful)

-

Pink Jeep Tours offers off-road tours to individuals and groups visiting the Southwestern U.S. hotspots of Sedona, Arizona, and Las Vegas, Nevada. Take a tour of the companys Web site at...

-

The following are unrelated accounting practices: 1. Pine Company purchased a new \(\$ 30\) snow shovel that is expected to last six years. The shovel is used to clear the firm's front steps during...

-

Identify whether the following statements are true or false. 1. One argument for IFRS is that there is less globalization in the world. 2. IFRS is accepted as GAAP in every country of the world. 3....

-

You will need isometric dot paper for this question. Part of a pattern using four rhombuses is drawn on isometric dot paper below. By drawing two more rhombuses, complete the pattern so that it has a...

-

Fred Flores operates a golf driving range. For each of the following financial items related to his business, indicate the financial statement (or statements) in which the item would be reported:...

-

In Problem use the given equation, which expresses price p as a function of demand x, to find a function f(p) that expresses demand x as a function of price p. Give the domain of f(p). p = 45 - e x/4...

-

The following information is available for Partin Company: Sales $598,000 Sales Returns and Allowances 20,000 Cost of Goods Sold 398,000 Selling Expense 69,000 Administrative Expense 25,000 Interest...

-

Using the data from BE11- 9, compute the depreciation expense for the first two years and determine the net book value at the end of the second year ( assume Hermit Associates uses the units- of-...

-

Using the data from BE11- 9, compute the depreciation expense for the first two years and determine the net book value at the end of the second year, assuming that Hermit Associates uses the double-...

-

Using the data from BE11- 9, compute the depreciation for the first two years and determine the net book value at the end of the second year, assuming Hermit Associates is an IFRS reporter that...

-

Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a...

-

Ohno Company specializes in manufacturing a unique model of bicycle helmet. The model is well accepted by consumers, and the company has enough orders to keep the factory production at 10,000 helmets...

-

Entries for Sale of Fixed Asset Equipment acquired on January 5 at a cost of $134,640, has an estimated useful life of 17 years, has an estimated residual value of $9,350, and is depreciated by the...

Study smarter with the SolutionInn App