J&S Amez Company began operations in 2017 and initially adopted the weighted-average method for inventory valuation. In

Question:

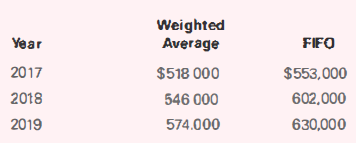

J&S Amez Company began operations in 2017 and initially adopted the weighted-average method for inventory valuation. In 2019, in accordance with the inventory valuation policies followed by other companies in its industry, Amez changed its inventory pricing to the FIFO method. The company still uses the weighted-average method of inventory valuation for income tax purposes. Amez has a 30% tax rate. The pretax income data is reported as follows.

Required

a. What is J&S Amez's net income in 2019?

b. Compute the cumulative effect on retained earnings from the change in accounting principle from weighted average to FIFO pricing (up to but not including the year of the change).

c. Show condensed, comparative income statements for J&S Amez Company. beginning with income before taxes, as presented on the 2019 income statement.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella