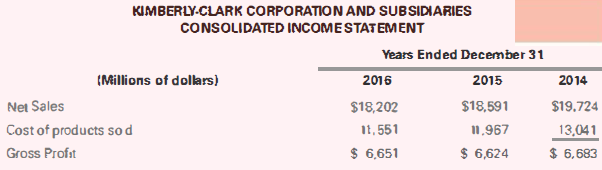

Kimberly-Clark Corporation and Procter & Gamble Company reported the following information about inventory in their financial statements

Question:

Kimberly-Clark Corporation and Procter & Gamble Company reported the following information about inventory in their financial statements and footnotes. Use this information to answer the following questions:

a. What cost-flow assumptions does Kimberly-Clark use?

b. What is Kimberly-Clark's LIFO reserve at the end of 2014, 2015, and 2016?

c. If Kimberly-Clark used the FIFO cost-flow assumption to account for all of its inventory, what would its balance of ending inventory be in 2014, 2015, and 2016?

d. What would Kimberly-Clark's cost of goods under FIFO have been in 2015 and 2016?

e. Would Kimberly-Clark's gross profit. taxes. and net income have been higher or lower under FIFO in 2015 and 2016?

f. Compare Kimberly-Clark's gross profit percentage, inventory turnover ratio, and days in inventory on hand under LIFO versus FIFO for 2015 and 2016.

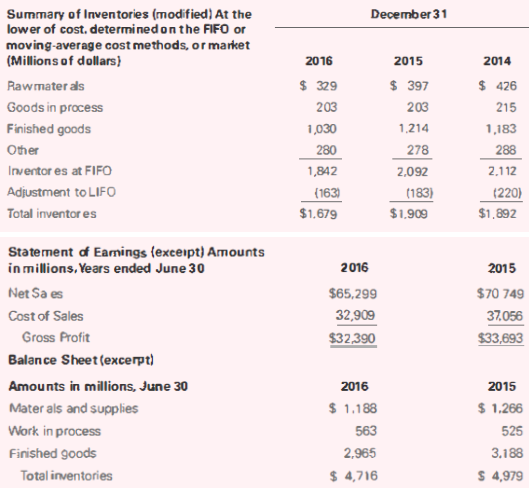

g. What cost-flow assumption(s) does Procter & Gamble use?

h. For fiscal 2016, compare Procter & Gamble's inventory turnover ratio and days in inventory on hand to those of Kimberly-Clark under FIFO from part (f).

Kimberly-Clark Corporation

Excerpt from 2016 Annual Report, Kimberly-Clark Corporation

NOTE 1: Accounting Policies (excerpt)

Inventories and Distribution Costs

Most U.S. inventories are valued at the lower of cost. using the Last-In, First-Out (LIFO) method, or market. The balance of the U.S. inventories and inventories of consolidated operations outside the U.S. are valued at the lower of cost, using either the First-In, First-Out (FIFO) or moving-average cost methods, or market. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. Distribution costs are classified as cost of products sold.

Excerpt from 2016 Annual Report, Kimberly-Clark Corporation

NOTE 17: Supplemental Data

Note 1: Summary of Significant Accounting Policies (excerpt)

Inventory Valuation

Inventories are valued at the lower of cost or market value. Product-related inventories are primarily maintained on the first-in, first-out method. The cost of spare part inventories is maintained using the average-cost method.

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella