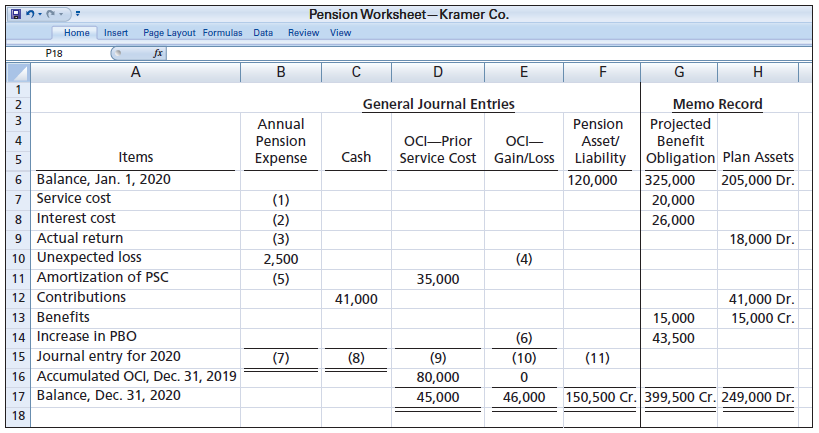

Kramer Co. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable.

Question:

Kramer Co. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2020.

Instructions

a. Determine the missing amounts in the 2020 pension worksheet, indicating whether the amounts are debits or credits.

b. Prepare the journal entry to record 2020 pension expense for Kramer Co.

c. Determine the following for Kramer for 2020: (1) settlement rate used to measure the interest on the liability and (2) expected return on plan assets.

Expected ReturnThe expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Question Posted: