Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it

Question:

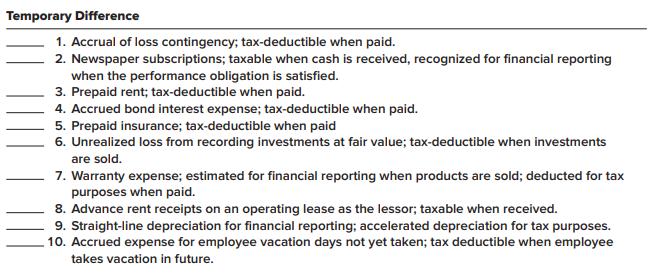

Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T).

Temporary Difference 1. Accrual of loss contingency; tax-deductible when paid. 2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied. 3. Prepaid rent; tax-deductible when paid. 4. Accrued bond interest expense; tax-deductible when paid. 5. Prepaid insurance; tax-deductible when paid 6. Unrealized loss from recording investments at fair value; tax-deductible when investments are sold. 7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. 8. Advance rent receipts on an operating lease as the lessor; taxable when received. 9. Straight-line depreciation for financial reporting; accelerated depreciation for tax purposes. 10. Accrued expense for employee vacation days not yet taken; tax deductible when employee takes vacation in future.

Step by Step Answer:

D 1 Accrual of loss contingency taxdeductible when paid D 2 Newspaper subscript...View the full answer

Intermediate Accounting

ISBN: 978-1260481952

10th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference. Temporary Difference...

-

Indicate by letter whether each of the transactions listed below increases (I), decreases (D), or has no effect (N) on retained earnings. Assume the shareholders' equity of the transacting company...

-

Indicate by letter whether each of the terms or phrases listed below is more associated with financial statements prepared in accordance with U.S. GAAP (U) or International Financial Reporting...

-

2. LIMIT COMPARISON TEST: SPECIAL CASES The Limit Comparison Test is most often used when the limit L= lim ak lies in the interval (0, oo). In the case where L is zero or infinity, we can still...

-

You have $10,000 invested within your registered retirement savings plan (RRSP) in common shares of Canadian companies. All taxes on earnings within your RRSP are deferred until the time when you...

-

1. What specific skills would a person have to be a successful director for a parks and recreation position? 2. What experience would a person have working with an elected board for parks and...

-

Market research Before bringing a new product to market, firms carry out extensive studies to learn how consumers react to the product and how best to advertise its advantages. Here are data from a...

-

Analyzing changes in retained earnings. Eaton Corporation, a U.S. diversified power management company, reported a balance in Retained Earnings of $2,796 million at the beginning of 2007 and $3,257...

-

Analyze the risks and rewards in Lease Financing

-

The Tiger Catering Company is trying to determine the most economical combination of sandwiches to make for a tennis club. The club has asked Tiger to provide 70 sandwiches in a variety to include...

-

Shannon Polymers uses straight-line depreciation for financial reporting purposes for equipment costing $800,000 and with an expected useful life of four years and no residual value. Assume that, for...

-

Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference. Temporary Difference 1....

-

Accounting has its own vocabulary and basic relationships. Match the accounting terms at the left with the corresponding definition or meaning at the right. 1. Posting A. The cost of operating a...

-

Name the two major preceding management theories that contributed to the development of quality management theory. Briefly explain the major concepts of each of these preceding theories that were...

-

922-19x 8 After finding the partial fraction decomposition. (22 + 4)(x-4) dx = dz Notice you are NOT antidifferentiating...just give the decomposition. x+6 Integrate -dx. x33x The partial fraction...

-

The answer above is NOT correct. The value of (2x + 1)(x + x)dx is

-

Review the resource on organizational theory. Explore the various theories and select one to use for this Discussion. Consider the strengths and limitations of the chosen theory. Compose an analysis...

-

How do the locations of Australian department store Myer affect the ability of the other factors of the operating model canvas (suppliers, organization, processes, and information/management systems)...

-

If you call the preceding function by typing newFunction("I", "you", "walrus"), what will the computer print? def newFunction(a, b, c): print a list1 = range (1,5) value = 0 %3D for x in listl: print...

-

The cash records of Holly Company show the following four situations. 1. The June 30 bank reconciliation indicated that deposits in transit total $720. During July, the general ledger account Cash...

-

Depletion and DepreciationMining Khamsah Mining Company has purchased a tract of mineral land for $900,000. It is estimated that this tract will yield 120,000 tons of ore with sufficient mineral...

-

Depletion, Timber, and Extraordinary Loss Conan OBrien Logging and Lumber Company owns 3,000 acres of timberland on the north side of Mount Leno, which was purchased in 1998 at a cost of $550 per...

-

Natural ResourcesTimber Bronson Paper Products purchased 10,000 acres of forested timberland in March 2010. The company paid $1,700 per acre for this land, which was above the $800 per acre most...

-

Answer please, A company uses the perpetual inventory system and recorded the following entry: This entry reflects a

-

As a Financial Analyst in the Finance Department of Zeta Auto Corporation they are seeking to expand production. The CFO asks you to help decide whether the firm should set up a new plant to...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

Study smarter with the SolutionInn App