McDonald?s is the largest and best-known global food-service retailer, with more than 32,000 restaurants in over 115

Question:

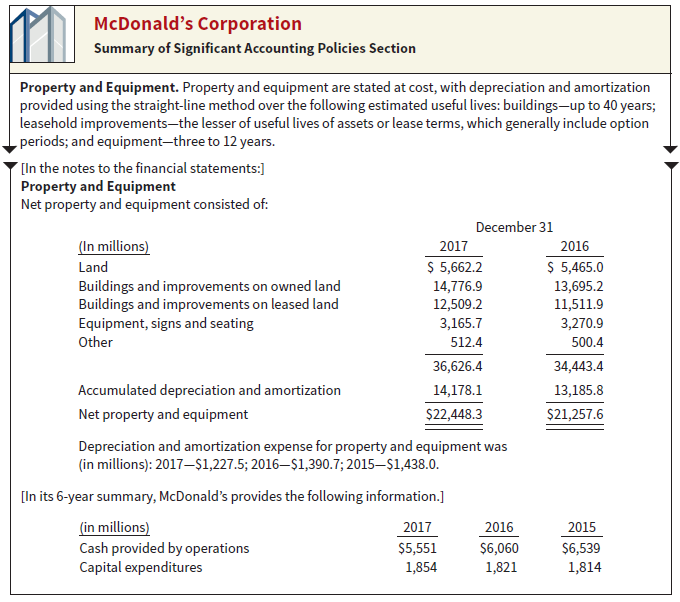

McDonald?s is the largest and best-known global food-service retailer, with more than 32,000 restaurants in over 115 countries. On any day, McDonald?s serves approximately 1 percent of the world?s population. The following is information related to McDonald?s property and equipment.

Instructions

a. What method of depreciation does McDonald?s use?

b. Does depreciation and amortization expense cause cash flow from operations to increase? Explain.

c. What does the schedule of cash flow measures indicate?

McDonald's Corporation Summary of Significant Accounting Policies Section Property and Equipment. Property and equipment are stated at cost, with depreciation and amortization provided using the straight-line method over the following estimated useful lives: buildings-up to 40 years; leasehold improvements-the lesser of useful lives of assets or lease terms, which generally include option - periods; and equipment-three to 12 years. [In the notes to the financial statements:] Property and Equipment Net property and equipment consisted of: December 31 (In millions) 2017 2016 $ 5,662.2 $ 5,465.0 13,695.2 Land Buildings and improvements on owned land Buildings and improvements on leased land Equipment, signs and seating 14,776.9 12,509.2 11,511.9 3,165.7 3,270.9 Other 512.4 500.4 36,626.4 34,443.4 Accumulated depreciation and amortization 14,178.1 13,185.8 Net property and equipment $22,448.3 $21,257.6 Depreciation and amortization expense for property and equipment was (in millions): 2017–$1,227.5; 2016–$1,390.7; 2015–$1,438.0. [In its 6-year summary, McDonald's provides the following information.] (in millions) 2017 2016 2015 Cash provided by operations Capital expenditures $5,551 $6,060 $6,539 1,854 1,821 1,814

Step by Step Answer:

a McDonalds used the straightline method for depreciating its property and equipment b De...View the full answer

Intermediate Accounting

ISBN: 978-1119503668

17th edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfiel

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

What explains the difference between cash flow from operations and earnings?

-

The MoMi Corporations cash flow from operations before interest and taxes was $2 million in the year just ended, and it expects that this will grow by 5% per year forever. To make this happen, the...

-

Cash flow from operations in a business is different than net income from operations in the same business. Discuss the difference in these two measurements of company activity. Which is most...

-

Fletcher Fabrication, Inc., produces three products by a joint production process. Raw materials are put into production in Department X, and at the end of processing in this department, three...

-

What is an STS? How are STSs generated experimentally? What are the uses of STSs? Explain how a microsatellite can be a polymorphic STS.

-

Given the following cost expenditures for a small warehouse project (to include direct and indirect charges), calculate the peak financial requirement, the average overdraft, and the ROR on invested...

-

What ethical guidelines might you propose for strategic decision makers when doing competitor Intelligence? (R-56)

-

During January, its first month of operations, Knox Tool & Die accumulated the following manufacturing costs: raw materials $4,000 on account, factory labor $6,000 of which $5,200 relates to factory...

-

The following data pertains to the manufacture of cigars during October: Total labor cost variance Actual hours worked Standard rate per hour Labor rate variance $18,000 unfavorable 9,000 $16 $14,000...

-

Presented below are the amounts of (a) the assets and liabilities of Canadian Gardening Consultants as of December 31, 2017, and (b) the revenues and expenses of the company for the year ended...

-

Use the information for Lockard Company given in BE11.2. (a) Compute 2020 depreciation expense using the double-declining-balance method. (b) Compute 2020 depreciation expense using the...

-

The following are three different and unrelated situations involving depreciation accounting. Answer the question(s) at the end of each situation. Situation I: Recently, Broderick Company experienced...

-

Who reads the business plan and what are they looking for when doing so?

-

9. [10] Suppose that B and W are BMs and that they are correlated with correlation coefficient P (-1, 1) in the sense that the correlation coefficient between Bt and Wt for all t>0. Then we can...

-

You have just incorporated and started your business. Your corporate pre-tax profit is $40,000. This is your only source of income. This income is eligible for the Small Business Deduction and is...

-

4. Provide the information requested in the statements below: a) Find and draw all C's that do not contain H's (if any). For this, redraw the structure where you show the d ('s). N b) Find and draw...

-

Suppose that f(x) = 8x + 5. (A) Find the slope of the line tangent to f(x) at x = 7. (B) Find the instantaneous rate of change of f(x) at x = -7. C) Find the equation of the line tangent to f(x) at x...

-

Whichof the following regarding the relationship between business risk and financial risk is least accurate based on our discussions in class? A. Business risk represents uncertainty caused by...

-

Expand (1 + 2x) (1 + 3x) 4 .

-

You are the newly appointed tax practitioner to complete Emilys tax return and have downloaded the prefill report for Emilys tax return (hint, you can read what a prefill report is here (Links to an...

-

Explain how the conversion feature of convertible debt has a value (a) To the issuer and (b) To the purchaser.

-

What are the arguments for giving separate accounting recognition to the conversion feature of debentures?

-

Archer Company issued $4,000,000 par value, 7% convertible bonds at 99 for cash. The net present value of the debt without the conversion feature is $3,800,000. Prepare the journal entry to record...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App