Michael's Incorporated reported the following tax information for its first 3 years of operations. Assume that in

Question:

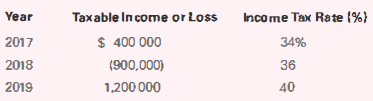

Michael's Incorporated reported the following tax information for its first 3 years of operations.

Assume that in 2018, there are no uncertainties regarding the realization of the NOL carryforward benefits. All tax rates were enacted at the beginning of the year. No tax rule changes are known until the year of change.

Required

Based on the information provided.

a. Determine the amount of any refund receivable from the 2018 NOL. In addition, indicate the amount of the tax benefits related to the NOL carryforward. Prepare any journal entries required in the year of the loss.

b. What is the after-tax net income or loss reported on the 2018 income statement?

c. Compute the amount of any tax due in 2019.

d. Determine the balance of the NOL carryforward benefits remaining at the end of 2019.

e. Determine the income tax expense reported for 2019 and prepare the journal entry needed to record the 2019 tax provision.

f. Repeal parts (a) and (b) assuming that management has negative evidence indicating that the firm will realize only 70% of the NOL carryforward benefits over the carryforward period.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0134730370

2nd edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella