Occidental Exports has income before tax of $660,000 for the year ended December 31. The companys income

Question:

Occidental Exports has income before tax of $660,000 for the year ended December 31. The company’s income tax rate is 30%. Additional information relevant to income taxes includes the following:

■ Capital cost allowance of $160,000 exceeded accounting depreciation expense of $120,000 in the current year.

■ The company received non-taxable dividends of $50,000.

■ The company paid $20,000 for club memberships for its executives. These membership costs are not tax deductible.

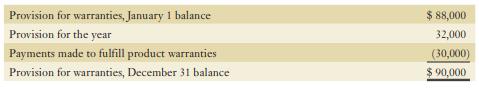

■ The company guarantees its products for three years after sale. For tax purposes, only actual amounts paid for warranties are deductible. Information on the warranty provision is as follows:

Required:

Prepare the journal entries to record income taxes for Occidental Exports.

Step by Step Answer: