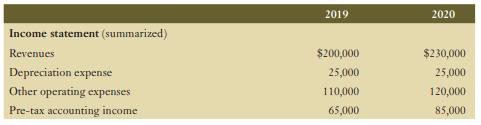

RCD Company started operations in 2019. The financial statements of RCD reflected the following pre-tax amounts for

Question:

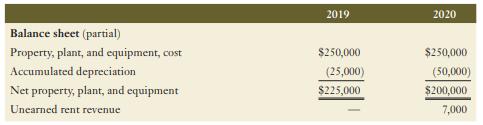

RCD Company started operations in 2019. The financial statements of RCD reflected the following pre-tax amounts for its December 31 year-end:

RCD had a tax rate of 30% in 2019 and 35% in 2020, enacted in February each year. The unearned rent revenue represents cash received from a tenant that will be moving into the building February 1, 2021. For tax purposes, any cash received for future rent is taxed when the cash is received. RCD claimed capital cost allowance for income tax purposes of $12,500 in 2019 and $23,500 in 2020.

Required:

a. Calculate the income taxes payable for 2020.

b. For each year (2019 and 2020), calculate the deferred tax balance on the balance sheet at the end of the year. Indicate whether the amount is an asset or a liability.

Step by Step Answer: